While it is entirely possible that prices will climb back above the trendline now being violated taht is not the way to bet at the moment. As for the knife catchers they are trying to treat this sell off as a buying opportunity. And it may well be. But that is not the way for prudent investors to bet.

While it is entirely possible that prices will climb back above the trendline now being violated taht is not the way to bet at the moment. As for the knife catchers they are trying to treat this sell off as a buying opportunity. And it may well be. But that is not the way for prudent investors to bet.

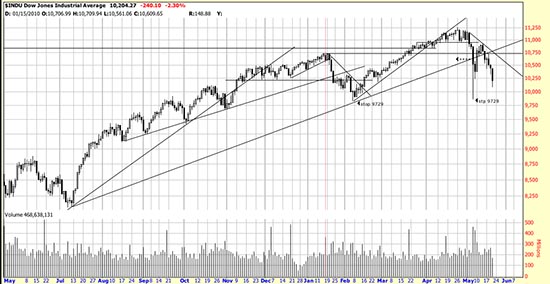

Prices are more than 3% under the trendline, and Magee thought that sufficient to take action.

Here is the complete picture. A trendline stretching back to June is being broken.

Here is the complete picture. A trendline stretching back to June is being broken.

We are constant advocates for not being 100% right or wrong (actually right or wrong is bad thinking — we should say instead accurate or in accurate). Meaning that you scale in and out of the market. So this break has not taken out the Mageesystems stop, but it has (is in the process of) taking out the trendline — an important trendline.

In our personal accounts we have been hedged for some days. We are now tilting to being slightly short.

A way for investors to hedge or short their portfolios is to buy the SPXU (3x short SPX) or DXD (2x Dow short) or Qs (QID).

As we said you can scale into shorts if you feel that a little protection is in order. We will not turn short 100% until the Mageesystems stop is taken out.