http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p69418865904&a=2032821185

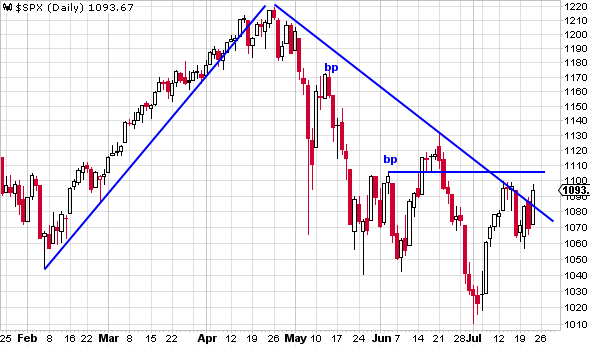

This is beginning to have the feeling of a Kilroy (H&S) bottom. Today’s surge powered across a signal line.

Now. Careful. The nature of signals is this: In trending markets they are dependable (within reason). In trading and changing markets they are treacherous.

The power bar across the trendline we usually take as a buy signal. Readers of course should be wary with 9 or 10 directional changes in the last 60 or so trading days. What do you do when you are wary? Trade smaller.

What about the Dow Theory sell signal? And our own Basing Points sell signal? Bear traps? Only time will tell. At any rate if the Basing Point here is taken out by 3% we have a system buy signal. Buying here is more speculative (and more profitable).

Banks will be a theme over the next year or so. It looks to us like the risk in C is limited. And though it just gave a false buy signal

Banks will be a theme over the next year or so. It looks to us like the risk in C is limited. And though it just gave a false buy signal

we think in a year or so we will look back and eat our hearts out at the thought we could have bought C at 4. Here is the thing. In our system if the trade doesn’t work you start over. So the stop is 2 or 3% under the July low. If it doesn’t work we liquidate it and wait for another chance.

Same with BAC

BAC is not a buy right now, but we will be watching it for the signal. Of course fundamentalists will say the banks’ license to rape pillage and plunder has been revoked by those communists in Washington. Don’t believe it. Not when those communists are depending on bank campaign contributions. Readers understand that buying now is a violation of the technical analyst’s first commandment: Never buy a stock in a downtrend. And as our favorite partner Lee Richartz (the unknown genius of American finance used to say: Never be in a hurry to do something stupid.

BAC is not a buy right now, but we will be watching it for the signal. Of course fundamentalists will say the banks’ license to rape pillage and plunder has been revoked by those communists in Washington. Don’t believe it. Not when those communists are depending on bank campaign contributions. Readers understand that buying now is a violation of the technical analyst’s first commandment: Never buy a stock in a downtrend. And as our favorite partner Lee Richartz (the unknown genius of American finance used to say: Never be in a hurry to do something stupid.

http://stockcharts.com/h-sc/ui?s=F&p=D&b=5&g=0&id=p86198945038&a=203282123

On the other hand F has thrown off a buy signal and we think it is a long term position. For some reason the horizontal line got misplaced here. Should be between 12 and 12.25. We don’t think it would be stupid to buy it now. We’d put the stop under the low three days ago. Not a valid Basing Point, but these are nasty times. And market mischief makers are pushing the markets every which way.

You will note that the link will give you perhaps a larger chart to examine, at stockcharts.com our new chart source.

Hi

Would a falling wedge be a valid pattern interpretation on the SPX/DOW?

Best,

“Alain”

Hi

Think, we may risk one more small down wave before an up move. It would be the 6th touch opposite of the trading direction. Volume too not expanded yet on the up move.

Target likely April high.

How do you see it?

Alain