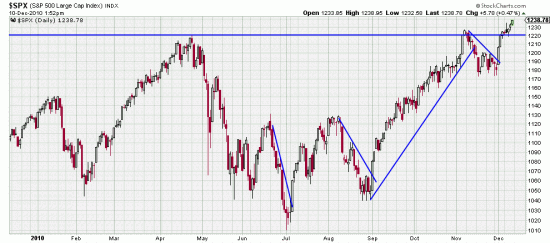

In our habitual jocular mode we at one time called this the dump-bump-dump-explode pattern. You could look at it as an A-B-C spring perhaps. Or maybe you could call it the specialist’s mouse trap. You sell the issue off vigorously. Dip buyers leap on the “bargain”. You sell it off again to punish them. Then in the nyah-nyah gotcha phase you create a power bar to taunt those short termers who bought, suffered, sold. The July and September patterns are really better exemplars of the d-b-d-e pattern, but the present one is the same except that it illustrates our dictum that an up or down wave can be followed by a sidewave — which is what happened in this case. These explosions, or power bars in this situation seem to be very dependable. Remembering always, of course that we are in a bull market.

In our habitual jocular mode we at one time called this the dump-bump-dump-explode pattern. You could look at it as an A-B-C spring perhaps. Or maybe you could call it the specialist’s mouse trap. You sell the issue off vigorously. Dip buyers leap on the “bargain”. You sell it off again to punish them. Then in the nyah-nyah gotcha phase you create a power bar to taunt those short termers who bought, suffered, sold. The July and September patterns are really better exemplars of the d-b-d-e pattern, but the present one is the same except that it illustrates our dictum that an up or down wave can be followed by a sidewave — which is what happened in this case. These explosions, or power bars in this situation seem to be very dependable. Remembering always, of course that we are in a bull market.

These are really wavelets, instead of waves –but as all life is fractal, except Congress, which is criminal– the principles (of which their only principle is reelect me) are the same.

We’re thinking of moving to France where the government is afraid of the people, rather than the people being afraid of the government. Vive la France!