We have been itchy lately, feeling like something is about to blow. You are undoubtedly aware of the famous stories about Soros, who gets a bad backache when his positions are on the edge of trouble. This is actually the same feeling we had back in April, right before the market fell over the cliff. And if you look at this chart of the VIX it should catch your attention. It’s getting back to that April low. To remind you, volatility reverts to the mean–sometimes violently. One thing professionals do when volatility gets to historic lows is buy straddles. We did that in the 1987 crash and made a killing. Straddles, of course, is a bet on a big move, long or short, because you’re long a put and a call. In the present case we think there is a ticking powder keg but we’re wondering if the explosion is going to be to the upside rather than the downside.

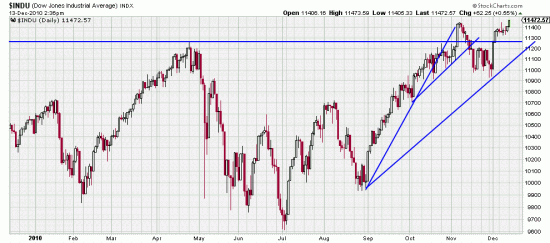

The S&P has broken out of the sidewave started in April, the Qs have gone to new highs and even the Dow is creeping upwards. Now these powerful signals taken together can always be a bull trap, but there is an old fashioned way to deal with that. Stops. In a day or so we will review all the major stops. For the moment let us poke at the contents of the powder keg (while smoking a Cuban cigar, naturally). The banks appear to be recovering, blameworthy though they might be.

Wall Street, of course, has recovered and is smoking those Cuban cigars and drinking $500 champagne. Health care is dumb fat and happy. The economy is clearly improving — 15 million unemployed to the contrary notwithstanding. And have you heard how difficult it is to walk into your Mercedes dealer and drive out an $80,000 car. Corporations have so much cash that they are looking for ways to blow it (usually through acquisitions). Can it be that happy days are here again (except for the 15,000,000)?

At the moment we are planning to add on to our positions because we think the bull market is still on, and might rocket ahead at any time. It wouldn’t be a bad time to find some shorts or look at the VXX — the volatility issue. Last time the market exploded (downside) it went from about 75 to 140, so it is a hedge. The problem is right now we don’t see any signals — and analysis is run on signals not on economic analysis.

Before we take the current level of VIX as a sell signal, however, we might consider that VIX was as low as 9.89 in 2007, nearly 10 months before the final tops in the price indexes.

The lowest level of the (new) VIX calculation was in 1994 at 9.4. Elliotticians may calculate a ‘trust’ down to 4 but that may be as questionable as their 400 Dow Jones target.

Alain