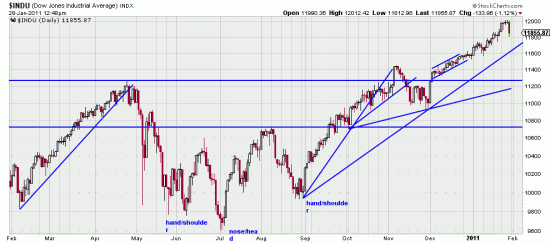

After 41 days of glacial drift upwards and (including today) 2 days of downdraft it looks like the wave has crested. And this would appear to be the undertow day. There is no way on earth (maybe in the stars or the spheres) to know how severe this wave will be. There is some fairly serious support at 11433. We think the likelihood of a major trend reversal here is negligible. the purpose of this downwave is to punish the public which has been getting out of bonds and back into equities. So probably 5% or so will be sufficient. The technical reason for the downwave is that there hasn’t been one for quite a while, added to which 12000 is a numinous figure.

After 41 days of glacial drift upwards and (including today) 2 days of downdraft it looks like the wave has crested. And this would appear to be the undertow day. There is no way on earth (maybe in the stars or the spheres) to know how severe this wave will be. There is some fairly serious support at 11433. We think the likelihood of a major trend reversal here is negligible. the purpose of this downwave is to punish the public which has been getting out of bonds and back into equities. So probably 5% or so will be sufficient. The technical reason for the downwave is that there hasn’t been one for quite a while, added to which 12000 is a numinous figure.

Here is a close up. Volatility explosions like this (1.3% in the Dow) are often the wave kick off. All you have to do is look at it to see the significance. On the other hand this downwave will be cushioned by people who have been shifting restlessly on the sidelines. We will inform you when the downwave ends so you can add on.

Here is a close up. Volatility explosions like this (1.3% in the Dow) are often the wave kick off. All you have to do is look at it to see the significance. On the other hand this downwave will be cushioned by people who have been shifting restlessly on the sidelines. We will inform you when the downwave ends so you can add on.

Of course other issues are being hammered today also. F, and the banks. As we have said over and over trend investors should regard these whippings with equanimity and not try to avoid their fate. This wave is against a huge upward tide in the market and will shortly subside.

If that doesn’t happen we will publicly eat crow and say we’re sorry. And break our crystal ball.

This weekend we will publish a more extensive analysis of the situation.

there seem to be an option on the S&P still to reach mid 1300s and the Nasdaq 100 somewhere into the mid 2400s.

Do you see the same?

Alain