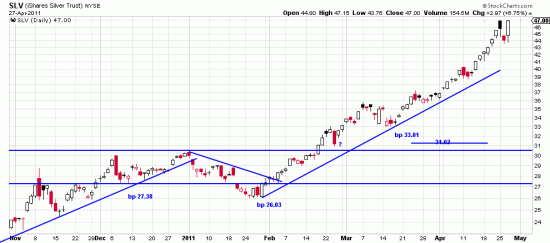

No sooner had we made an analysis of the silver market than the silver market turned around and made us look like chumps. What a difference a day makes — or four or five hours. Now that the day is over what do we think? Well we think that readers who follow our advice to trend-invest and not trade are smart readers. We’re thinking about following our own advice. Traders (ourselves included) were just head-faked, and when we took the fake silver scored (on us).

No sooner had we made an analysis of the silver market than the silver market turned around and made us look like chumps. What a difference a day makes — or four or five hours. Now that the day is over what do we think? Well we think that readers who follow our advice to trend-invest and not trade are smart readers. We’re thinking about following our own advice. Traders (ourselves included) were just head-faked, and when we took the fake silver scored (on us).

It would appear that what we took for a signal of the top is canceled by today’s action. When signals are so untrustworthy caution is advised. So we are not convinced yet that the top signal is canceled. But we are convinced that readers who follow our trend signals are all right and are right to do so. (Actually, when we were talking about our accounts selling silver we neglected to note that we had a trend following account which stayed long. So sometimes we follow our own advice.)

We are very skeptical that a volume climax like that of three days ago can be overcome. While there may not be a plunge here experience says that at least consolidation must be in order.

Every once in a while the market likes to remind us that we are not as smart as it is. We think it is treachery time in this market.

For trend investors no problem. For traders head scratching time. We will trying to catch this quicksilver as it slides back and forth over the next few days.

Some sideways consolidation would be nice. I

jumped the gun too before reading the first post.