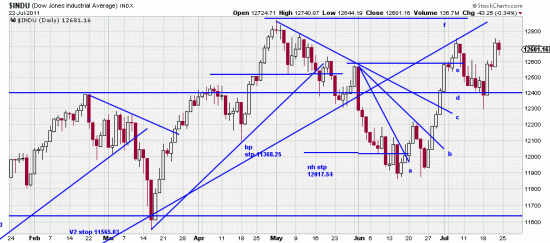

We have remarked on the unreliability — treachery if you will, or false signals — that are inherent in mule –or sideways– markets. This may be seen at e above where the new high was quickly turned back on what should have been an acceleration. That line, from March 09 is crucially important. While broken the market can nullify the break by powering upward, which it appears from the past few weeks it was attempting to do. The line from March 09 is now a resistance point.

We have remarked on the unreliability — treachery if you will, or false signals — that are inherent in mule –or sideways– markets. This may be seen at e above where the new high was quickly turned back on what should have been an acceleration. That line, from March 09 is crucially important. While broken the market can nullify the break by powering upward, which it appears from the past few weeks it was attempting to do. The line from March 09 is now a resistance point.

We have characterized this whole period since May as naked mud wrestling. That description also fits what is going on in Washington — as does treachery, back stabbing and sabotage. So the market and Washington are not so different — and what goes on in Washington is affecting — in a strange way — what is going on in the market. It is exceedingly strange to see the market surging upwards while the politicians play with matches around a powder keg. For awhile we were long the VXX and GLD as a hedge against that foolishness. But the charts told us to liquidate those trades and get long the indices. Ever obedient we did that — while scratching our head and wondering if the market knows something we don’t. Maybe it does. Maybe it is gaily canoeing down the river towards Niagara Falls.

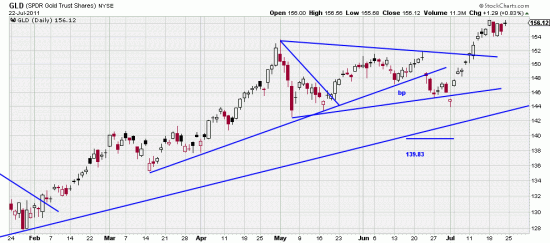

As an example of market treachery gold after breaking out has stalled:

Here gold made a head feint down out of the triangle, gapped back and eventually broke out on the upside. If you wanted to get technical you could expect that break out to reach a point calculated by adding the base of the triangle to the breakout point. It might still, but it looks stalled here.

Here gold made a head feint down out of the triangle, gapped back and eventually broke out on the upside. If you wanted to get technical you could expect that break out to reach a point calculated by adding the base of the triangle to the breakout point. It might still, but it looks stalled here.

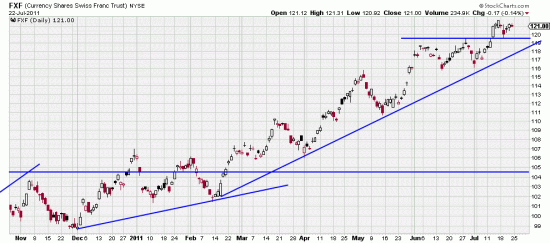

And then there is the swiss franc:

Price behavior could be just a typical return to the breakout line — and it is like everything else right now — the picture of uncertainty.

Price behavior could be just a typical return to the breakout line — and it is like everything else right now — the picture of uncertainty.

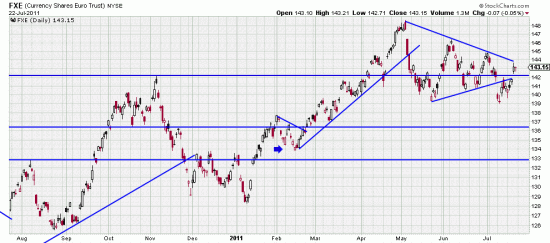

Reflecting the economic and political crosscurrents the euro broke down out of a triangle, and then after faking out every trader in the world returned to the corral.

Reflecting the economic and political crosscurrents the euro broke down out of a triangle, and then after faking out every trader in the world returned to the corral.

The market’s purpose in this kind of (mis) behavior is to demoralize investors and chase them from the market — while pushing the indices hard. Investors would be wise to keep to the long view and not participate in this wrestling contest.