We crawled out of our nuclear fallout shelter, blinked in the sun and said — how about that. They haven’t destroyed the market yet. We immediately rushed out and bought gold to hedge our risks. And thanked the market gods that they gave us a chance to do this. Mamon akbar! Mamon akbar! (As everyone knows — or should know — Mamon is the god of the markets.)

So, for today we dodged a nuclear bomb — but there’s always tomorrow (and tomorrow and tomorrow …creeps… until August 3 when teotwawki (the end of the world as we know it) will occur.)

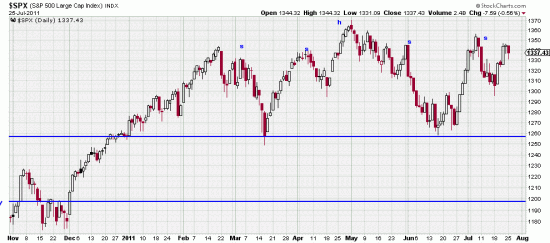

If that weren’t enough to worry about, here is something else: a massive head and shoulders? Could be, rather beautiful in its formation and in an ominous place — its neckline intersecting with the trendline from March 09. A trendline which is already broken in the Dow. Also, interesting intersection between the Variant 2 stop and the neckline.

As everyone knows we never predict (burned many times by Niels Bohr’s law as well as the Heisenberg Principle –also by Newtonian law that what goes around comes around). With that warning we point out that if this should be a head and shoulders the measured target is 1127.52.

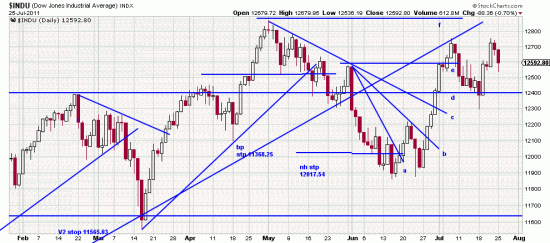

Here is a close up of the formation which exhibits fearful symmetry. Two shoulders each side. For what it’s worth the formation in the Dow is not so perfect. Good news. For what else it’s worth the NASDAQ looks very like this. Bad news. For whatever else beside that it’s worth the Dow formation might be a hunchbacked head and shoulders with a severely sloped neckline. And, the March 09 trendline is already broken as prices scramble to get back above the trendline.

The same elements of head and shoulders are here, but not so symmetrical and clear. Regardless the picture of the three indices is not encouraging — especially in the present explosive political environment. Playing with matches is never something irresponsible children should do, and especially not around head and shoulders formations.