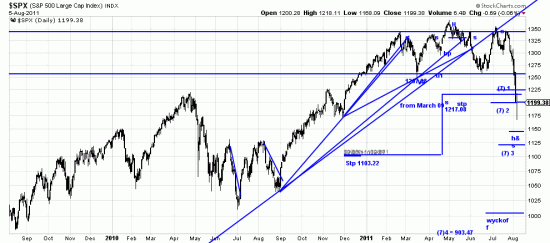

Thursday Cody and Altucher started buying. Sooner or later we will make them famous by noting their buy opinions on the chart.

A 13.2% downwave in the SPX (in 12 days) is nothing to get in front of. Unless you are trying to make a reputation and an eye rolling performance record. Of course if you’re wrong and get killed you won’t ever talk about it again, and if you’re lucky and it does turn out to be a bottom you can claim to be a genius. We don’t treat the accounts of our rseaders so cavilerly. We are in the process of a market meltdown and buying here is extremely risky — whether you are day trading or trend trading. See 10 Trading Lessons: Bottoms our ebook on bottoms in which you will see formations like this in late 2008-09. Of course you remember what happened later. March 09 happened.

Many talking heads, advisors, letter writers, money managers hemmed and hawed and backed and filled and tap danced when we published our letter on the head and shoulders market. Embarrassed that they hadn’t seen it themselves. Refusing to believe because it didn’t fit their bull market beliefs. Their clients are considerably poorer now.

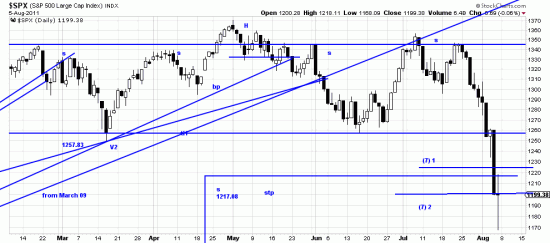

Some interesting aspects to this chart (aside from the fact that we have marked targets calculated with various methods.) After the latest panic days there are days which appear to reverse the wave. (The days with small bodies and long tails, or shadows.) What is happening here is that “smart” and contrarian traders are trying to apply the lesson they learned in the 2008-09 crash –that the panic is creating a buying opportunity. Well, yes. But not yet. So they rush in on long range down days thinking they are getting bargains and that prices are cheap. What is happening is that they are being sucked into a bull trap. You have to wait until there is a sign of a bottom, not just buy radical sell offs. (e.g., a-b-g-z waves.) As we illustrated in the book.

12 historic trading days. And now S&P that paragon of honesty and integrity (really?) has exposed itself to ridicule by downgrading the US as a credit risk. Le credit risk c’est lui. Now a company without integrity S&P should theoretically have billions in potential liabilities because of its mal-performance in the mortgage securties meltdown. In addition Terry McGraw (who inherited the company and is hardly an advertisement for self made CEOs) is anxious to distract attentionh away from himself and his personal mal-performance. On top of that they made a two trillion dollar math error in their analysis of the government. These are guys we should trust to teach elementary school math?

That a dishonest company could slander the US Government is ironical. Pot calling the kettle black. Nonetheless the move will exacerbate volatility in the markets for a few days. Note that all the edwards-magee stops are tripped. We are now in an accelerating down wave. Shorts are best, or detached observation from the sidelines.