The past six months have been one of the most turbulent experiences of our fifty years in the market. The volatility, the false signals the naked mud wrestling (not co-ed). It is no mystery to us why this is so. Start with one of the historic bear markets fueled by two wars, a historic tax cut, a historic refusal to fund the wars, a historic refusal to take fiscal responsibility, a historic implosion of the housing market, historic unemployment, a historic refusal to deal with the problem by a dysfunctional congress (except for their ability to make insider trades with impunity).

Add in European chaos, Greek irresponsibility (with the collusion of Goldman Sachs) German reluctance to bail out their fellow citizens, (understandable). Don’t forget the massive sun spots and solar flares.

Above all there is the nature of market participants. Now worse than at anytime in the past the market is dominated by hedge funds, flash traders and, evidently large day traders – very large day traders. In short the composition of market participants is not healthy, but is destructive. These people thrive on the conditions we have been experiencing for six months. Theirs is just a grab money game and the welfare of the public and the market be damned.

Consequently the general public and long term investors, upon whom the market depends for its long term welfare, are either standing aside or have gone to bonds altogether – or money market funds. If we put on our economist’s hat we could see hitting these people (the villains) with a Pigovian tax – that is the sin tax. Or alternatively hitting them with a baseball bat.

Indicative of the difficulty of these markets the brilliant investment stars of the last decade have been imploding and turning into black holes. Bill Gross, master bond trader made the worst move of his career. John Paulson (the good Paulson, not the evil Paulson) gave back a major pile of his chips. And Friday’s WSJ, voice of the 1%, (and Rupert Murdoch), featured the record of the fall of Bill Miller of Legg Mason Capital Management which used to manage $20.8B (illion) and now manages $5B.

Some of his trades were detailed. He lost 96.4% in Freddie Mac; 96.2% in AIG; 73.4% in Citigroup; 67.6% in Eastman Kodak. Mr Miller obviously knows from nothing about stock trends and stops. The article maintains that as these issues slid down the slope of hope he increased his commitments. One is of course astounded. Our dullest graduate student knows that you do not ever take a position without a stop, and you do not cling to a stock in a downtrend, much less double down on it. We don’t live in Hollywood, so we take no joy in the misery of others. But we are willing to make an object lesson of them. There but for the grace of God and a trend analysis and stop go you.

These bad habits were not punished, but rewarded in the ‘90s. But these are not the ‘90s. And “Value Investing” without discipline is just as bad as monkeys throwing darts at charts.

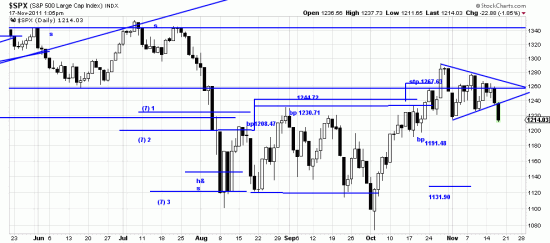

We are hedged, based on the power bar breakdown of the triangle, but our systems stops are distant and the present situation is to say the least murky.