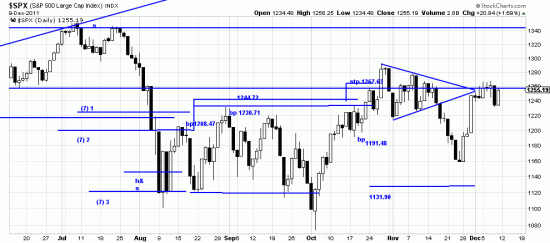

Or, making sense of the senseless. From Aug 8 to Oct 21 the market writhed (wrothe?) sideways finally breaking out enough to suck systems in long. Itr had alread sucked traders in short first week October in the bear trap which we ignored. The October wave high may still turn out to be a bull trap. But at least we can interpret what is going on. The exit from the trading range should in any rationally run universe represent the market’s readiness to rise.

Or, making sense of the senseless. From Aug 8 to Oct 21 the market writhed (wrothe?) sideways finally breaking out enough to suck systems in long. Itr had alread sucked traders in short first week October in the bear trap which we ignored. The October wave high may still turn out to be a bull trap. But at least we can interpret what is going on. The exit from the trading range should in any rationally run universe represent the market’s readiness to rise.

But this is not a rationally run universe. It is a news run universe. And each bit of news is magnified by the ultra short term traders who have control of the market. It aappears that the average length of trends is one day — maybe two. A wave which lasts seven or eight days (without an air pocket) is enshrined in the Hall of Fame. More common is the one day bungee move of 198 Dow points — up. Down. Up. Or whichever way it didn’t go last. Of course this is annoying, but it will go on until Angela gets it together or Sarko throws in his cards or we have an election. (Forget the election part. That will not solve anything unless the election sweeps one party into total power — all three branches — oh, you thought the third branch was not elected. Silly you. You must have missed the way the Supreme Court voted in the 2000 election.)

The antidote to this is very long term investing. Systems investing. Right now the system is long, and should be. There also exists the possibility that the exit from the aug-Oct range just means the range is extended, in which case the top of the range is now the July top. There is some theoretical (and practical) reason in this. In fact some of the most punditish pundits of the market (Thomas deMark) is (are) confidently predicting 1340 S&P in this phase.

We are predicting more of the same.