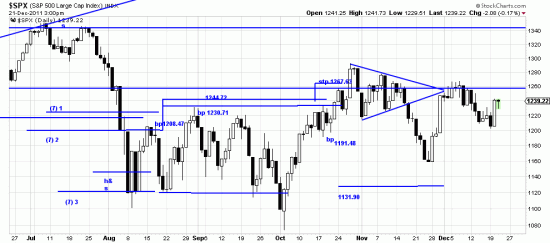

A 348 point move in the Dow followed by…duh… probably qualifies as an idiot if not Shakespearean move. Trying to make sense of it from an economic viewpoint would be a waste of time. It was a purely technical move starting a new wave after two eight day waves and an antidote to trader boredom. We suspect there will be eight days of upwave. After all the idiots (oops, pundits) are all primed and waiting for the Santa Claus rally. Since we don’t do cycles or analogues we look at these things with a fresh, if jaundiced, eye. If we were looking for an analogue here it would be trench warfare in World War I. Nonetheless long is still the way to be as indicated by the Basing Point stop at 1131.

A 348 point move in the Dow followed by…duh… probably qualifies as an idiot if not Shakespearean move. Trying to make sense of it from an economic viewpoint would be a waste of time. It was a purely technical move starting a new wave after two eight day waves and an antidote to trader boredom. We suspect there will be eight days of upwave. After all the idiots (oops, pundits) are all primed and waiting for the Santa Claus rally. Since we don’t do cycles or analogues we look at these things with a fresh, if jaundiced, eye. If we were looking for an analogue here it would be trench warfare in World War I. Nonetheless long is still the way to be as indicated by the Basing Point stop at 1131.

Now watch closely while the leopard changes his spots:

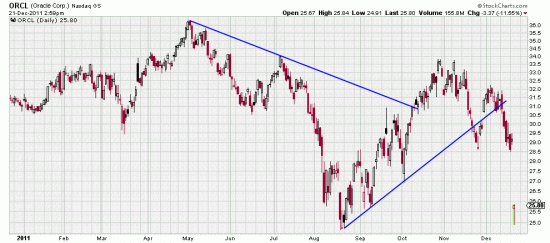

At least 700 times we have told you not to buy stocks in the situation Oracle is in. But this plunge in Oracle probably represents a buying opportunity. Moderately high risk, but if you stopped it 2% under today’s low you might get a bargain.

At least 700 times we have told you not to buy stocks in the situation Oracle is in. But this plunge in Oracle probably represents a buying opportunity. Moderately high risk, but if you stopped it 2% under today’s low you might get a bargain.

On the other hand RIMM has turned into a potentially dangerous situation for shorts. Takeover rumors are circulating. If we were short we would be closing or hedging our position. It’s been a good run and that is when things turn ugly, just when you are halfway through the bottle of champagne and not paying attention.

On the other hand RIMM has turned into a potentially dangerous situation for shorts. Takeover rumors are circulating. If we were short we would be closing or hedging our position. It’s been a good run and that is when things turn ugly, just when you are halfway through the bottle of champagne and not paying attention.