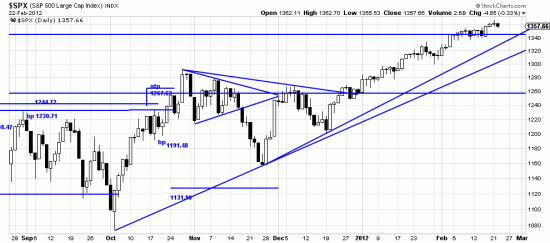

No and at this rate we may never get there. We now have a series of waves 82 days long amounting to a near 25% advance. The last leg of the wave — the present one — is 44 days and near 11%. This wave has created extreme restlessness in the investment community. There are pundits who still think we are in a secular bear market, and analysts who believe that the present profits rolling in will be repaid by God with the black plague. Add to them the contrarians, the traders, the pessimists, the anarchists, the guilt ridden who want to be punished and –not least — shorts who are having their shorts squeezed.

No and at this rate we may never get there. We now have a series of waves 82 days long amounting to a near 25% advance. The last leg of the wave — the present one — is 44 days and near 11%. This wave has created extreme restlessness in the investment community. There are pundits who still think we are in a secular bear market, and analysts who believe that the present profits rolling in will be repaid by God with the black plague. Add to them the contrarians, the traders, the pessimists, the anarchists, the guilt ridden who want to be punished and –not least — shorts who are having their shorts squeezed.

It must follow, as the night doth the day… that a downwave will correct some of this preLenten exhuberance. We originally put our positions on as trades, and the market has been busily converting them to trend trades.

Readers who follow our systems trades will see that the entry at the end of October (for which they were promptly punished by a downwave) now looks pretty good in retrospect. After all, there are investors salivating on the sidelines who didn’t get in. Let us repeat: Fear of risk is mitigated by a well chosen stop, which lets us know exactly what we are risking. The unworthy and unwashed who plunk their money down when Maria or Cramer bays at the moon set to sea in a pea-green boat and no stop and no plan.

So let us talk of tactics. You never should try to be all right, or all wrong. Scale in. Scale out. In fact you could scale positions back here as one way of dealing with an unusually long wave. (You can always put them back on.) You can hedge part of your position –with puts or with the short ETFs. We read in Barrons of traders who are closing their longs and buying three month calls.

We will be right on top of it, as the saying goes, like a duck on a juney bug. If the bug squeaks we’ll let you know.

Some perspective is offered by the chart. The active Basing Point dates from October. The stop is down in Patagonia. What is interesting about this is that it gives the market an enormous cushion. You can always of course, use a new high stop as we have described at length in StairStops.

And, of course, you can do the most powerful thing of all: Sit. As I remember it was Jesse Livermore who said “My butt made me a lot more money than my trading ever did.” The system stop will tell you if you have to fold your tents and flee.