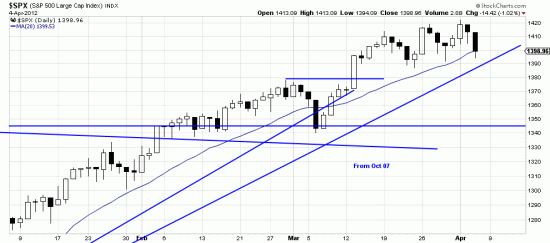

Frequently a volatiility explosion, as we had today in the market, is the signal for an abrupt change of trend. And this could very well be the beginning of a new downwave. The likelihood of its being a major trend change is in our opinion virtually non-existant. There may be a sharp and moderately painful downwave here but the likelihood of a major change is extremely remote.

Frequently a volatiility explosion, as we had today in the market, is the signal for an abrupt change of trend. And this could very well be the beginning of a new downwave. The likelihood of its being a major trend change is in our opinion virtually non-existant. There may be a sharp and moderately painful downwave here but the likelihood of a major change is extremely remote.

More likely what we have here is the flush phase. In this wave the market ejects arrivistes and the unwashed before setting off on a major new upwave. If you look at a lot of charts you often see this phenomenon — a sharp sell off followed by a bull market.

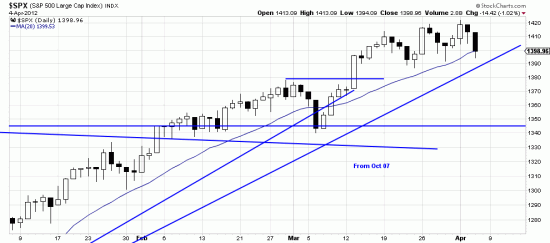

Looked at in a longer time frame we can see how little today means. Nonetheless it has spooked a number of analysts. As for ourselves if the momentum continues downward we will adopt partial hedges.

Looked at in a longer time frame we can see how little today means. Nonetheless it has spooked a number of analysts. As for ourselves if the momentum continues downward we will adopt partial hedges.

The truth is that readers and investors who seize this as an opportunity to add on longs and not bother hedging will come out better in the long run.

Notice that the longterm trend stop is so far away that you can’t even see it on this chart. The stop is in Patagonia visiting penguins.