Or dancing with tarantulas. The markets over the last week or so have had the fingerprints of the big hedge funds on them — trading aggressively as they grab seats for the musical chairs game. Frankly the tarantella is not our dance — jotas we can stand and sambas but most of all waltzes — as in… Matilda. But the last few days have a nasty resemblance in miniature to the bungee markets of last August to October.

Or dancing with tarantulas. The markets over the last week or so have had the fingerprints of the big hedge funds on them — trading aggressively as they grab seats for the musical chairs game. Frankly the tarantella is not our dance — jotas we can stand and sambas but most of all waltzes — as in… Matilda. But the last few days have a nasty resemblance in miniature to the bungee markets of last August to October.

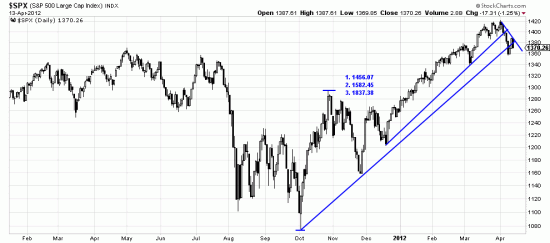

Of interest in the markets in general — and the SPX in particular is the pattern being set up — or perhaps already set up — the alpha, beta, gamma zeta pattern. A pdf on this pattern which resembles in some aspects the A-B-C wave formation is at:

http://www.edwards-magee.com/files/ggu/Alpha beta gamma waves.pdf

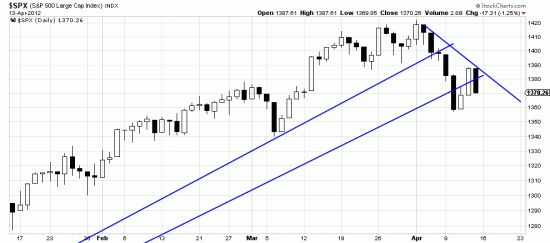

The sell-off Friday offers us a tentative point to draw the downtrend line from 8 days ago. If the pattern is fulfilled the gamma (C) wave should proceed lower. When that wave turns and prices proceed higher (zeta wave) and break the line we have a reentry or add-on signal. All very academic or theoretical at this moment, but important to understand. As is the breaking of the October trendline here which will have to paid off — either with a downwave of some sort, or perhaps bungee markets for awhile. As we already pointed out the market has to shake the Etch-a-sketch in order to set up the next wave up. Observant readers will note that, just as the market moves up in waves, that portfolio equity moves upward in waves. Retracement in market prices and retracement in equity are as natural as days of sunshine being followed by nights of Cabriria. (Cabiria? How did Stromboli get in here? We’re leaving before this gets any more surrealistic…)