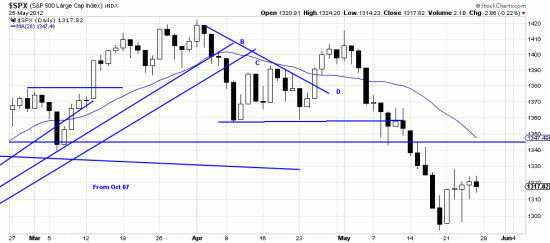

Or it could be called the week of the long tails. Wednesday was nothing less than bizarre with the Dow down triple digits and then reversing to finish up. All in all the SPX transversed 86.9 points to close up 22.60. Here is the way we read it: Lots of bears are still hiding in the woods and betting their opinion, driving prices down. Other contrarians and investors are seizing these prices as opportunities. The extreme ranges — 9.97 to 24.18 — reflect a struggle going on for the soul of the market. But overall we see the market being born again as a bull calf (Molach?–well, whatever). This all looks like wave ending and reversing behavior, and our personal accounts are long. Readers , who in general are more patient and smarter than we are, probably never blinked, though prices got within a hair (1291.98) of the Basing Point stop (1289.51)

Or it could be called the week of the long tails. Wednesday was nothing less than bizarre with the Dow down triple digits and then reversing to finish up. All in all the SPX transversed 86.9 points to close up 22.60. Here is the way we read it: Lots of bears are still hiding in the woods and betting their opinion, driving prices down. Other contrarians and investors are seizing these prices as opportunities. The extreme ranges — 9.97 to 24.18 — reflect a struggle going on for the soul of the market. But overall we see the market being born again as a bull calf (Molach?–well, whatever). This all looks like wave ending and reversing behavior, and our personal accounts are long. Readers , who in general are more patient and smarter than we are, probably never blinked, though prices got within a hair (1291.98) of the Basing Point stop (1289.51)

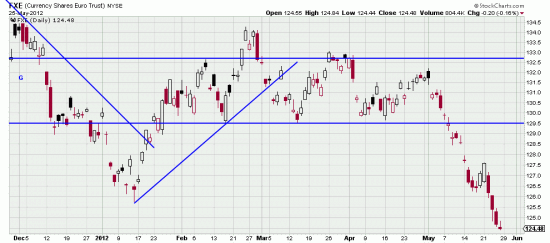

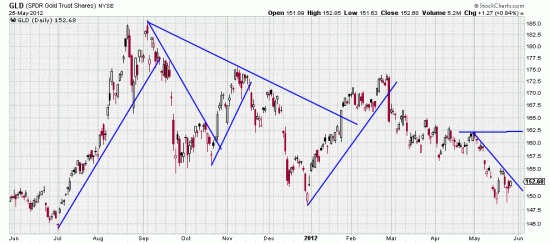

Meanwhile, long the gold, short the euro, long the dollar index were fortunate positions:

The euro looks like a no brainer now –Classical signals. We read that it has farther to fall. That may well be a bear flag which would presage yet more, as if messages in Greek and Spanish didn’t decode into “Sell the euro.”

The euro looks like a no brainer now –Classical signals. We read that it has farther to fall. That may well be a bear flag which would presage yet more, as if messages in Greek and Spanish didn’t decode into “Sell the euro.”

Taking a flyer as always we got long gold on the power bar whereas good not bold technicians would wait for the trendline to be broken, or the horizontal line to fall.

Taking a flyer as always we got long gold on the power bar whereas good not bold technicians would wait for the trendline to be broken, or the horizontal line to fall.

A degenerate and corrupt Congress (oxymorons for morons?) destroyed the meaning of Armistice Day and conflated it with all our military tragedies to produce Memorial Day. From a family with its share of medals, from WWII to Vietnam we honor it. 3 p..m. Monday (California time) the nation will observe a moment of silence to commemorate the fallen.

.