We are in the process of watching a take no prisoners struggle for control of the market. Last week the market was hammered by four days of hard selling — only to spring back like a jack-in-the-box on Friday. Today we are getting some follow through. In the face of Spain, Greece, the Olympics and Kim Kardishian this resilience is notable.

We are in the process of watching a take no prisoners struggle for control of the market. Last week the market was hammered by four days of hard selling — only to spring back like a jack-in-the-box on Friday. Today we are getting some follow through. In the face of Spain, Greece, the Olympics and Kim Kardishian this resilience is notable.

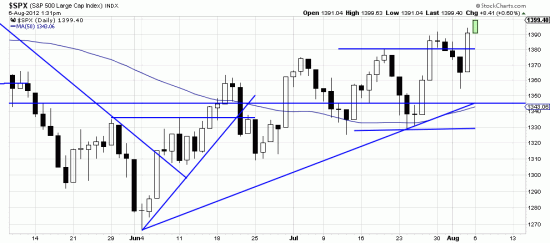

There is so much negativity and pessimism in the air — and on the net that one must examine the bases of this body of opinion. We discount totally Marketwatch and all the other opinion shops. But we have colleagues who do extremely fine work and their work implies some technical bearishness. Which brings us to say that we don’t use indicators. None. We analyze the charts, and the charts show us a strong uptrend since June. So who ya gonna believe? The indicators or your lying eyes?

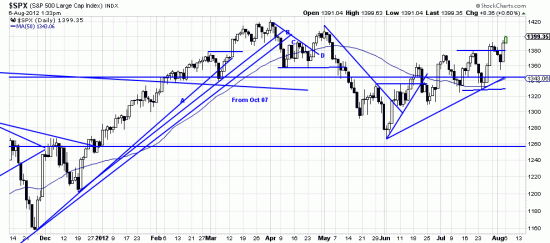

Some people are even saying tht we are putting in a top here. That only draws attention to their ignorance. We just had a top and we are now in the response wave to that top. Here is the 9 month picture.

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p84676359717&a=214966864

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p84676359717&a=214966864

We had a strong trend from October to April — 6 months — and the trendline was broken and a double top was formed the results of which was the downwave from May to June. We made a bottom and the present upwave is the natural result of everything since October. It’s really quite simple. Natural market forces remain in charge in spite of economics, politics, and even high frequency traders.

As we have said many times, we don’t know what the future holds, but the chart tells us what to do right now. And right now we have an uptrend.