http://stockcharts.com/h-sc/ui?s=$INDU&p=D&yr=5&mn=0&dy=0&id=p54002857514&a=234104255

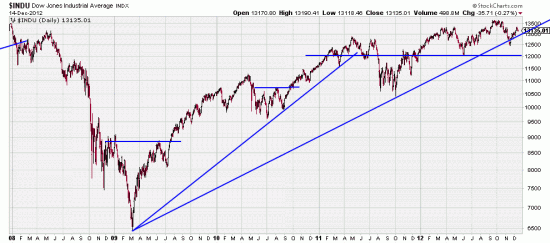

Sometimes we are amazed at what the analytical community (and talking heads, and nattering nabobs and beauty commentators) misses — as in this picture which shows prices bouncing off the most important trendline on the chart. From that critical moment in 2009 when the parachute blossomed and the market stopped its freefall. This is, of course, a numinous line. Break it under the right circumstances and wake the bear — a veritable grizzly.

But by our analysis this is unlikely in the present context. We think this line (and the horizontal trendline) are acting as support at present, and will continue to do so until a higher high is made. In other words, the bulls lives, and likely will continue to do so — bears gnashing teeth to the contrary not withstanding.

There is another reason which is similarly persuasive. It is just almost impossible to have a major bear wave without a major bull wave. (No guarantee of this.) If you look at all the major downwaves in Dow history there is, without fail, evidence of the market going parabolic and breaking out with irrational exhuberance prior to the fall. It would really be unfair for the market to crash at this point. Unfair and unprecedented (not that it couldn’t do that of course). In fact one of the philosophical justifications (teleological) for the existence of the market is as a reality teaching machine.

But enough of Aristotelian logic. On to the structure of the present market:

http://stockcharts.com/h-sc/ui?s=$INDU&p=W&yr=4&mn=0&dy=0&id=p62721365281&a=239474697

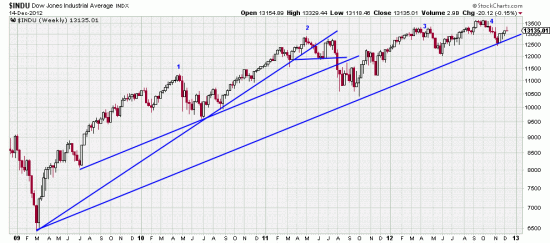

Just looking at this chart you can see that no major fall has been set up. Since March of 09 there have been four waves up, each labeled here. Each wave weaker, and each wave resulting in a corrective downwave. It is these downwaves which are responsible for the essential health of the market at this moment. Had there been no corrective downwaves over this period we would be in large danger, as the market advance from 09 is impressive — and, without the intervening downwaves, parabolic.

At the same time, of short term importance, the likelihood of near time volatility is extreme. The naked mud wrestling in Washington is very likely to result in mayhem in the short run. This will not take out long term positions, but will result in a buying opportunity. (Also an equity drawdown.) It would not be foolish to be hedged here (but we are only partly hedged). If the volatility were on the upside we would experience that delicious regret of having missed the profit because of the hedge. But if the volatility were on the downside and we were just even we would feel wise as Solomon.