Earlier today we noted that the Dow Transportations (etf IYT) was breaking some medium term trendlines. That provoked us to examine some other important charts and what we saw made us want to haul the foodbags up the tree against a bear raid.

http://stockcharts.com/h-sc/ui?s=IWM&p=D&yr=0&mn=6&dy=0&id=p10639251671&a=229975465

The Russell 2000 (IWM) is breaking a 4 1/2 month trendline from November.

http://stockcharts.com/h-sc/ui?s=$COMPQ&p=D&yr=1&mn=7&dy=0&id=p67504396251&a=234482827

The NASDAQ (COMPQ) is breaking the same November trendlines.

http://stockcharts.com/h-sc/ui?s=$INDU&p=D&yr=0&mn=7&dy=0&id=p38041005120&a=298224028

http://stockcharts.com/h-sc/ui?s=$INDU&p=D&yr=0&mn=7&dy=0&id=p38041005120&a=298224028

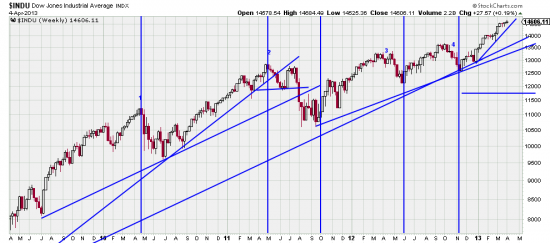

The industrials are within easy reach of a bear attack. About 170 points, and will be closer still Monday. A close up above, and below the long term picture.

http://stockcharts.com/h-sc/ui?s=$INDU&p=W&yr=4&mn=0&dy=0&id=p62721365281&a=239474697

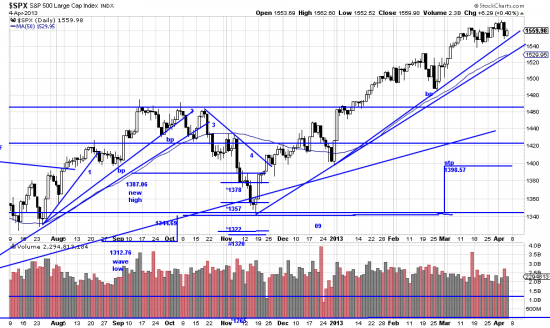

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p34555890157&a=214966864

The SPX is similarly situated. To the November trendline is about 30 points. But the tighter trendline is only 13 points away. Recently we saw a 20 point range in the SPX. Given the baying of the bears and the howling of the wolves this weekend would be a perfect time to attack the market in the futures. We don’t want to cry “bear!” here needlessly but it is well to remember the Cyprus attack, which occurred in the futures on the weekend. If there is an attack we expect it to be short sharp and shallow, but when our bear detecting antennae are vibrating like they are we want to get those food bags well off the ground so there’s something for breakfast.

We will be doing some hedging in our accounts tomorrow. Raise them foodbags high, campers.