http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p88150915824&a=214966864

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p88150915824&a=214966864

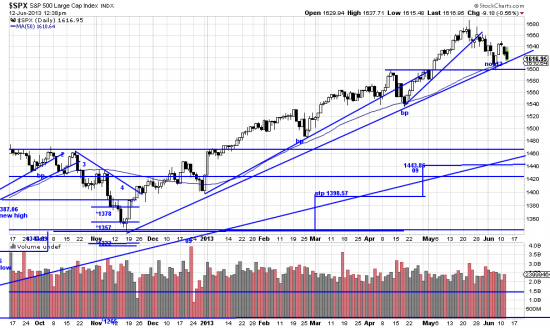

Squirrels (and traders) are running about frantically trying to figure out when the next Fed boot will drop. Cassandras and the guy with the end of the world as we know it sign are advertising a bear market to rival the 07-08-09 bear. But, as Rudyard Kipling said, if you keep your head when all about you are losing theirs… The way to keep your head is to analyze the chart. Above, the big picture — so messy that only a mother could love it, but it shows where prices would have to penetrate to change the trend — a long way.

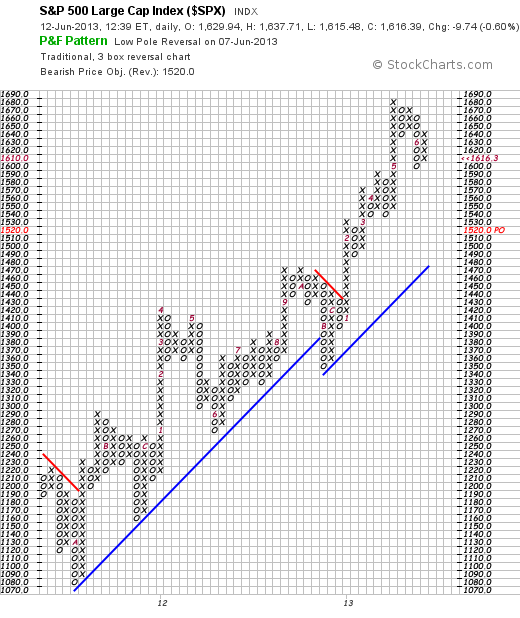

On the other hand the present market squall is discomfiting, and it is from tropical depressions that hurricanes develop. The PnF chart is looking for a protracted correction here. We don’t really anticipate that, but good practice demands that you look at all the tools.

(sorry, no link, but you can go to stockcharts.com and see a bigger version) This method looks for a target of 1520.

(sorry, no link, but you can go to stockcharts.com and see a bigger version) This method looks for a target of 1520.

At the moment the market is holding on to the short term wave by the skin of its teeth.

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p55455624798&a=266398464

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p55455624798&a=266398464

The important trendline here is from November 12 and is about 137 trading days long. The present turbulence is endangering this line. An authoritative break of this line (and subsequently of the horizontal line would be unpleasant, but not definitive. We have marked a stop at 1449.92 calculated from the new high method. At the moment we think the likelihood of that stop being taken out are 70-30 against. The probabilities of the Nov 12 line being penetrated are 55-45 for. But we think if this occurred prices would be supported by hungry money looking to enter the market.

The present market mood and condition reminds us of the markets in Aug-Oct 2011 when the squirrels and bungee jumpers ground up equity for months. It must be remembered: the purpose of downwaves is to purge the market of the unwashed and unworthy. Strong hands with good technical methods are not dislodged from the market by a firefight. Or by squirrels running about shouting the sky is falling. The sky is falling. (Wait, are we mixing metaphors here — wasn’t that … Squirrel Little?)

Do something productive. Go watch the Open.