(sorry no link possible)

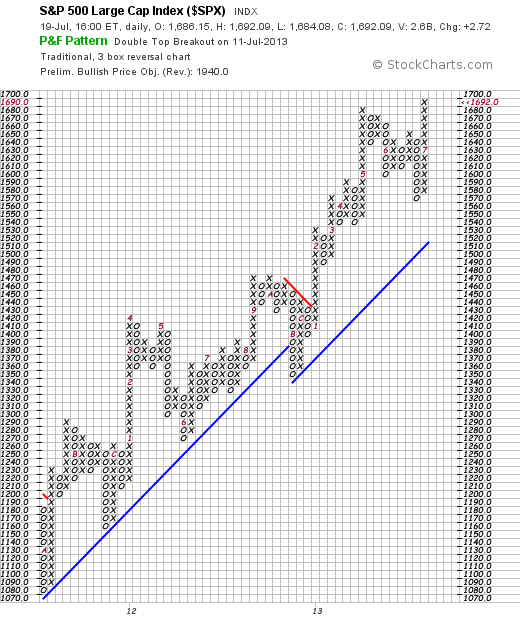

The PnF method, finding a breakout on the 11th, computes a price target of 1940 for the SPX. Jack Schannep, the eminent Dow Theory analyst noted this week that the Transportations had confirmed the Industrials at new highs, thus clearing the way for a fully invested portfolio. The question is not whether you believe this, but whether you have confidence in it. We do.

It matches with our analysis, though we decline to forecast on such a long time frame. The likelihood of reaching 1940 without some blood being shed is somewhere between nil and zero. Especially with the Congress working full time to sabotage the economy. (Cf Paul Krugman and every other enlightened Keynesian (we’re one))

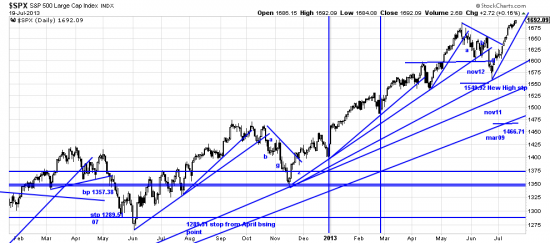

But right now, hoist the spinnaker. Just a second there — a few words on the present situation. We have made new highs — and as is to be expected there is some stuttering here and contrarians sell the new highs. And of course the Chicken Littles and the Cassandras are baying at the moon: Dow 5000 (do not be deceived we know we are mixing metaphors with a vengeance. We do it to get even with all those composition teachers who repressed us for coloring outside the lines.)

Magee wants us to see prices break the high by 3% — and that is what the prudently conservative will wait for before pushing all their chips into the pot. If we put on our economist’s (five gallon) hat we would balk at such optimism, but from the technical viewpoint you can’t pour so much money out of a helicopter without affecting equity prices. In addition investors are trapped like ratsl and so they are pouring capital into the market. Just look at the surge off the wave low: 19 days like a rocket.

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=1&mn=6&dy=0&id=p43199796180&a=266398464

Here we see a very steep trendline on the zeta wave. Will be broken quickly and has limited if any significance. The next line down is more important — worth 3-5% maybe and below that are the truly important lines, from Nov 11 and Mar 09. When those are broken we will have a bear market. At the moment it’s open season on bears.