http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p83750808625&a=214966864

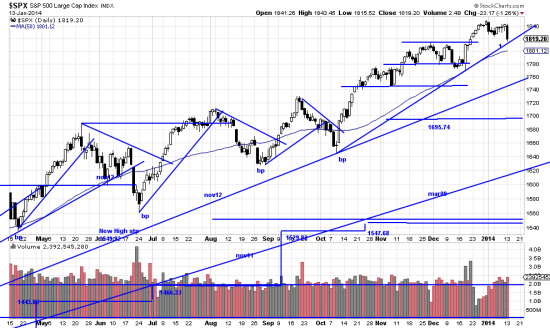

In our last post we asked whether the market was becalmed or readying a sneak move. Today the contrarians answered the question by hammering the market. We have remarked (didn’t we?) that before you take the market up you have to shake out the arrivistes and johnny-come-latelys. Also the unwashed and unworthy. This cleansing process happens with such regularity that we should write a paper on it but right now it’s more fun to look at present events and situation. The formation at 1 could well turn out to be the pattern often observed at such times, the alpha-beta-gamma (or A-B-C) (http://www.edwards-magee.com/?p=3803) pattern where alpha sells off, beta bounces and then gamma punishes those who don’t know what’s going on. This is occurring just as the trendline at 1 is very vulnerable. Decisive penetration of this line could give us the downwave that would set up the next important wave up (and be uncomfortable). It should not be unduly discomfiting, as there is ample support from 1750 to 1810. Most importantly, as this turbulence subsides we will have the opportunity to add on to our positions.Answered questions (like answered prayers…)

This Post Has 2 Comments

Leave a Reply

You must be logged in to post a comment.

Having a bit of trouble seeing the alpha-beta-gamma pattern. Was yesterday’s sell-off the start of the alpha or was it the start of the gamma? Many thanks.

I’m having difficulty seeing it too. But if there is such a thing the 13th would be the gamma or C wave. May just be a garbage sidewave. Difficult to interpret. Pattern, whatever it is, is result of contrarians trying to knock market down, and buyers seizing every sell off as an opportuity to buy.