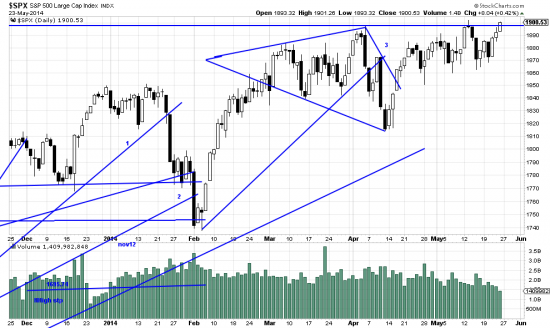

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p83257770514&a=266398464

Forget the science part. There is none at present which is dependable. Technicians are running around crazily calculating RSIs and MACDs and computing cycles and “analogues” and throwing the I Ching and dusting off their crystal balls. Sound and fury signifying nothing. There is some interesting work by Paul Desmond at Lowry’s. (You can see it at edwards-magee.com/ggu/desmond1.pdf and desmond2.pdf and desmond3.pdf. If you read these you will know as much or more than most analysts.

But it will not tell you what to do now, and that is where the art comes in. Art and solid technique and method. During the sideways market of the last two and a half months we have repeatedly pointed out that good practice dictated that patience was the tactic of the moment. Today that appears to be validated, as the SPX has closed at a new high, and may well have broken out. This remains to be confirmed and is not yet a signal to add on to positions. Of interest is the fact that over the past 25 days sell offs have made higher lows. What was disquieting during this period were the days which saw prices fall like dead ducks (up to 30 points), from the opening bell to the close. But buyers stepped up and now we have a new high.

We could well be into a new phase. Next week should give us some indication.

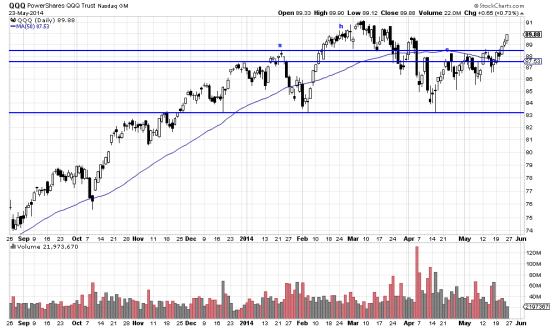

The Qs turned back from a crucial line, crossed a crucial line, and gave us a buy signal, so we bought some.

http://stockcharts.com/h-sc/ui?s=QQQ&p=D&yr=0&mn=9&dy=0&id=p78289658344&a=349010665

Readers will note that we have during this period said that neither buying not selling was advisable. We must think a new phase has begun. Either that or we can’t resist an obvious signal.

The spirit is strong but the flesh is weak. Don’t go to sleep. The extremely low volatility readings can just be a sleeping volcano.