http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p83257770514&a=266398464

Haji Baba worth $160 B? Beats worth $3 B (beats us –also rational analysis)? Whatsapp worth $3 B? Really? This and similar silliness all over the market make one wonder when the market will deliver a little nemesis to this hubris. Apple transversing a range of virtually 5% on a day when it spanks its critics with the introduction of more potentially game chaging technology. If one occupied his time with searching for analogues (we don’t) it wouldn’t take long to find the 2000 top and run screaming from the market. But, as always the market will tell you when to bail out, not the indicators or the state of the moon (beware! Supermoon on the horizon.) or the next bit of journalistic wretched excess. Acute readers will note that we have added a new new high stop at 1892.91.

What the market tells us right now is that prices are struggling at the numinnous number of 2000, and a breakout there, and confirmation have not occurred yet. Round numbers such as 2000 have — as Augustus remarked, numen. And the back and forth here tells us to hold off on new commitments until confirmation occurs. Meanwhile the talking heads at Goldman and Morgan are talking about 2150 in the SPX. We analyse this as eminently feasible and present action is probably constructive to this end.

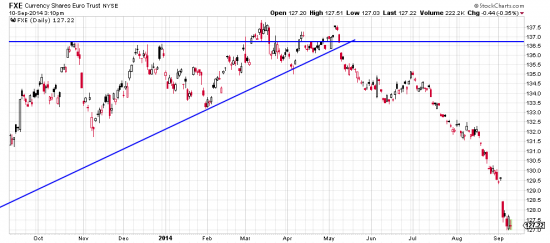

We shorted the euro. A pretty obvious and late trade. We were probably chasing trout when it should have been sold, but analyst estimates say it could go to 1.19 and we could certainly see that.

http://stockcharts.com/h-sc/ui?s=FXE&p=D&yr=1&mn=0&dy=0&id=p33634513359&a=340345374

Our experienced take is that IPOs are usually overpriced and not worth it, but don’t let that stop you from taking a flyer (small). Stay tuned we will be posting some deep analysis (or spurious market wisdom) shortly.