http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=6&dy=0&id=p09524411098&a=266398464

As seen a short term trendline is broken, more significant at this moment than usual because of the precarious state of the market. bp10 has raised the long term stop as shown to 1943.85. We also calculated a new high (not exactly, but close enough for government work) 1995.23.

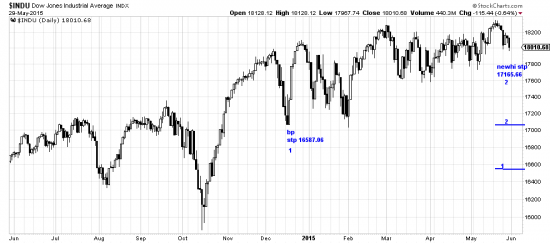

http://stockcharts.com/h-sc/ui?s=%24INDU&p=D&yr=1&mn=0&dy=0&id=p25278077721&a=410252756

In the DJI the basing point stop is 16587.06. We also caalculated a new high stop here which is 17165.66.

http://stockcharts.com/h-sc/ui?s=%24COMPQ&p=D&yr=0&mn=6&dy=0&id=p32407830969&a=346603762

The compQ stop is 4750.32. You will see these points more clearly if you click on the links to see larger charts.

The new high stops are for aggressive (or itchy) investors. (Isn’t everyone itchy now?) While a downwave is overdue it is unlikely that it would take out bp system stops. That would truly be a major change of trend and we don’t see any signs of that at present. At the risk of boring ourselves even sillier investors who grin and bear these drawdowns beat the itchy always. Penetration of these stops would be a general signal causing reexamination of every position and exit or hedging.

Editorial Practices

Unlike most of the financial industry we believe in complete disclosure and trasparency, so we tell readers when we make trades for our personal accounts. This is a little tedious but at least it’s honest. We are now scaling out of our long term longs in UPRO, in order to reorient our personal trading to futures and options. This does not mean that we won’t have skin in the game with our readers. Our family accounts will continue to be managed with the basing point system. If this new trading is successful we will offer it to clients — and we will not be recording every trade here as there will presumably be many trades and that would be really tedious to record.

We continue to maintain, based on our analyses, that there is at least one more leg in this fabulous bull. And we think that the market will probably punish longs before taking off on that leg. That’s traditional.