http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=3&dy=0&id=p76611673066&a=266398464

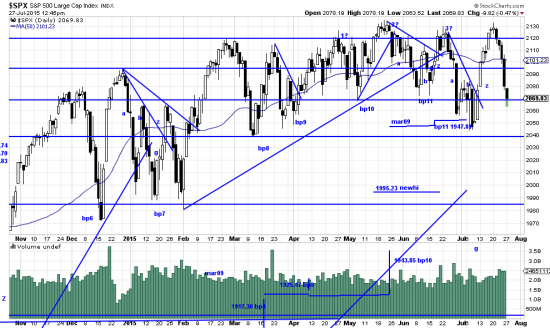

Since February we have observed the market grinding its way nowhere. In this process we have seen wedges and –potentially– a head and shoulders. Investors have apparently left the market or not re-entered. And when the cat’s away the mice will play, and the contrarians have been having a field day — and undoubtedly wracking up some nice profits. This is their favorite kind of market. We investors can largely overlook this mousing around — until it carries on too long and becomes obnoxious.

The rest of this week will probably mark a rebound as the Fed will rush to say, we didn’t really mean it and we’ll do it so slow you won’t even notice. And the Chinese government will say, get out the helicopters. (you can venture your opinion of their market management with the bear ETF FXI). Also after 5 days down the market tends to rebound just because all the traders know that after five days down the market rebounds.

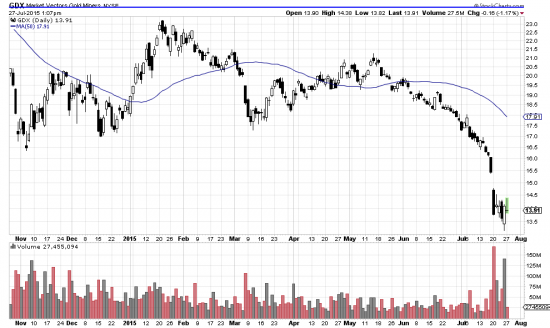

It never pays to fight the tide, and so bearish bets on gold (GLL) and silver and gold miners (as we have been saying for several weeks) are a good thing to have in the portfolio.

http://stockcharts.com/h-sc/ui?s=GDX&p=D&yr=0&mn=3&dy=0&id=p45528358457

GDX, the gold miners which you can short with DUST.

http://stockcharts.com/h-sc/ui?s=GDX&p=D&yr=0&mn=3&dy=0&id=p45528358457

http://stockcharts.com/h-sc/ui?s=QQQ&p=D&yr=0&mn=6&dy=0&id=p77043336279&a=416316591

We are very bullish on the Qs in the long run. Right now after this island reversal we might be shorting it with QID. But we have also showed the Basing Point stop for the long term investor.

In concert with the nasty tenor (Sopranos say the reason tenors make those beautiful sounds is because they have empty heads.) the INDU has an ugly pattern.

http://stockcharts.com/h-sc/ui?s=%24INDU&p=D&yr=0&mn=7&dy=0&id=p51053375451&a=417742260

The last three highs here are declining –lower highs, lower lows. Not a happy pattern.

So do we expect the bears to finally feast on bull steaks? Actually we fall back on the technician’s market maxim: the present trend will tend to continue. And any of these shorts we mention can be entered with a five percent stop — or as tight or loose as you like.

http://stockcharts.com/h-sc/ui?s=GDX&p=D&yr=0&mn=3&dy=0&id=p45528358457