We’re lost, but we’re making good time.

Yogi Berra Roshi

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=6&dy=0&id=p38955316076&a=266398464

How did we get here? Or perhaps just as important, where are we?

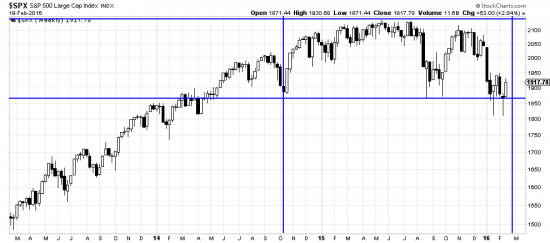

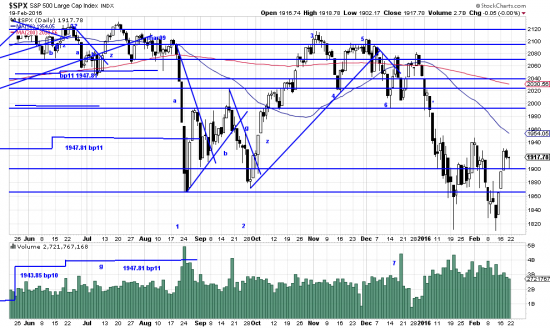

We presume to answer these questions by walking backwards to Babylon (home of mystical pleasures). By this method we will never lose sight of where we came from. Where we came from is illustrated by the chart as a general view. We are in the box. The box is a metaphor for markets which are in a free fire zone — where HFT traders and contrarians take advantage of ample volatility to seek rent at the expense of the public and general investors. In this process they extract profits from large investors also.

At this point the 09 bull market is officially (we are the official) over. We are presently in a clear downtrend. At this moment prices are drifting sideways and may be bottoming but that remains to be seen. There may be a trade or two in here, but going long against the trend is a fruitless enterprise.

We have run a rule of seven analysis on the market to see if a technical analysis might give us some idea of what the potential downside might be. Not a pretty picture. Targets are 1)1706, 2)1613, 3) 1459. A broad brush treatment and should not be depended upon. We are very uncertain of it as we are very uncertain of any trade at this time.

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=6&dy=0&id=p38955316076&a=266398464

Fundamental factors — China, oil, weak economic growth, anemic corporate profits (to name only a few)– have weakened the market and sapped its strength. The upshot of a plethora of negative influences has left investors uncertain and confused and demoralized. This condition will endure until at least the oil market stabilizes. But we will recognize a new market from the chart.