http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=1&mn=0&dy=0&id=p52620829748&a=459175088

Our title is taken from a Marketwatch story. No “snark” — no “schadenfreude” — just plain old facts. In fact we have never seen one episode of Cramer. Not one. On the other hand, just from what we have casually read, we know his entire schtick — and not just his performance act, his investment philosophy and trading methods also.

We also knew the content of Marketwatch’s story. Everybody (don’t they) knows that stock handicappers can’t match or worse, even match, the indexed market. We have known that from theory and philosophy from the moment we placed our first bet. Fifty years of experience have confirmed that instinctive understanding — stock picking is less dependable than horse handicapping.

Please note: exceptions exist.

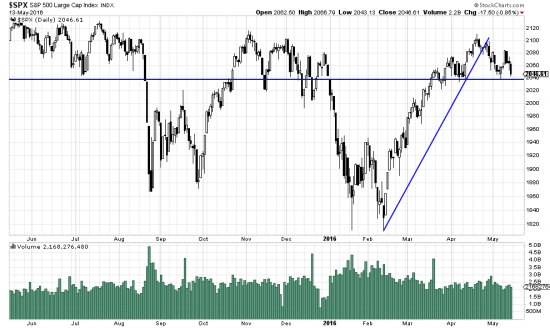

Please also note that the pundits and talking heads are trying to whip up a frenzy for a head-and-shoulders in the SPX.

We think that is pretty unlikely. Even if it were an H&S it is of little import and would only reverse the upwave from February and then only to the depth of 79 points. You don’t turn around a 66 month bull market with 6 weeks of activity. We have been in the counter wave (a sideways) to the 07-09 bust since oct15 and the mar09 trendline was not broken until aug16. A total of nineteen months to the present — which is still part of the sidewave reaction to the great bull market.

In the chart the last trendline is the important one. Certainly our readers will be singing out in chorus: Every trendline break has implications. We expect this one will stay well within the confines of the range of 1824- 2134.