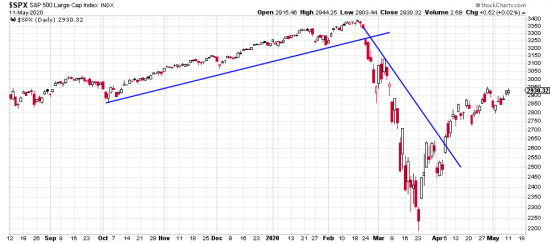

There is a certain shape to most of the charts of the market. Some individual charts show variations but withal market action has left behind similar tracks. As follows:

A long long upwave whicch terminated with one of the subtlest tops we have ever seen. Followed by a Niagra falls and extremely violent conditions. Most of the activity we have seen on the first wave down are bizarre in the extreme and we have repeatedly warned readers that risks during this period are beyond analyzable. Although we saw a buy signal when the zeta wave pierced the downtrend line we advised and practiced miniscule commitment to the market.

We see no change in those conditions. Agile well capitalized traders have made handsome profits in this period but we are not interested (nor are our readers) in baby sitting a trading station. So the strategy remains minimal capital comitment and maximum alert.

The exception is, for example, are positions with a five year or more timeline. We think Amazon, IBM, Google are stocks that can be scaled into and held for the long term. The risks here will remain large –more or less 8% . Expect continued volatility and risk surprises until at least Nov 20.