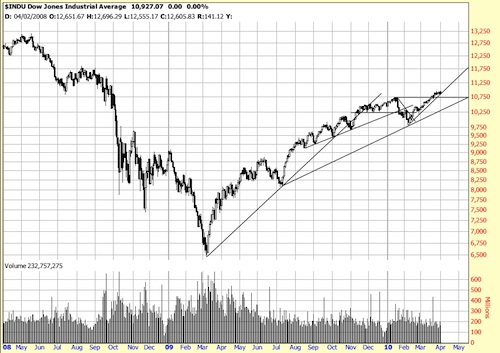

In October we warned that the breaking of the trendline from March would have some consequences. So far these consequences have been decidedly minor in nature. Assuming of course you liked the 8% (m/l) downwave in February.

In October we warned that the breaking of the trendline from March would have some consequences. So far these consequences have been decidedly minor in nature. Assuming of course you liked the 8% (m/l) downwave in February.

There has been little difference between the reaction of the S&P to the Dow, except the S&P might have reacted to the trendline break with a little more sideways action. Of course we think you should always be in both ETFs — the SPY and the DIA.

There has been little difference between the reaction of the S&P to the Dow, except the S&P might have reacted to the trendline break with a little more sideways action. Of course we think you should always be in both ETFs — the SPY and the DIA.

Right now the dominant trendline is from July in both. The sharply angled trendline from February should experience a downwave at any moment. You could struggle against it and sell some calls or buy some puts but this is probably self defeating tactics.

Despite the hand wringing and bewailing there is no sign at present in the market at the moment of severe (greater than 8%) downwave action.

This is a little strange — given the millions of mortgages in trouble and the unemployment rate. But the market is a barometer of the future and it is saying things are going to be all right. Strange.

But you don’t go to war with the market you want, you go to war with the market you have. (As a famous Washington figure put it.)

I am a relatively new subscriber and I very much enjoy your commentaries.

Where can I read about how to draw and interpret the trendlines which frequently appear on your charts (like the ones from Apr. 5th) and in your reports? Is there a good chapter in Technical Analysis you would direct me?

Thanks.

Chapters 14 and 15 of Technical Analysis of Stock Trends, 9th Edition as basic preparation. Lots of practice with a ruler. Mark up some charts and post them to the edwards-magee google group and I will comment. I give a special workshop on this subject in my graduate seminar starting in May at GGU if you are in the SF area. I will look through my material and see if I have a more concise explanation.