There is a famous story about J.P. Morgan (man, not bank) who went down to Pittsburgh to look at his steel investments. After touring the mills he asked the General Manager to sum up the situation. Said GM, Couldn’t be better. J.P. went back to his hotel and wrote a telegram to his broker in NY. “Sell all my steel.”

There is a famous story about J.P. Morgan (man, not bank) who went down to Pittsburgh to look at his steel investments. After touring the mills he asked the General Manager to sum up the situation. Said GM, Couldn’t be better. J.P. went back to his hotel and wrote a telegram to his broker in NY. “Sell all my steel.”

Readers should be, like ourselves, sitting on many open profits — in all the indices, in C and BAC and F — holy moly Batman, lots of stuff –.. Basically things are going as they are supposed to be going for Magee type investors. You get on a trend and sit and watch the paint dry. While this is boring it is entertaining and amusing watching the pundits and talking heads and Ouija board readers jump up and down on the trampoline and worry and agonize and predict and forecast and think up reasons and do “research”.

Don’t get hubristic. Right after that happens the market gods will make you part of the entertainment.

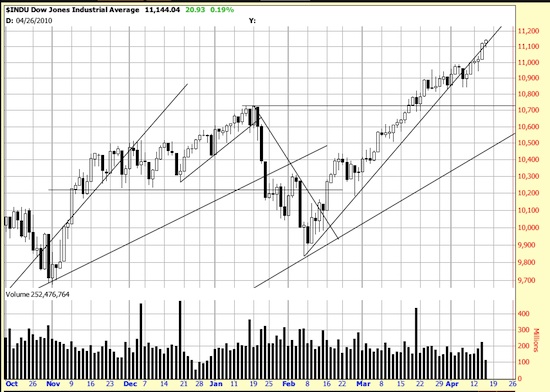

In fact it’s worth worrying a little at this point. This uptrend is now 48 days and 13.32% long. Without any significant downwave. Now here is the interesting statistic: From the old high to this high measures 3.87%. Magee’s Basing Points Procedure, in what we call Variant 2, resets stops when this occurs (when a new high exceeds by 3% the old high). In this procedure you take the high day and use its low as the Basing Point, and set the stop 5% down. Otherwise the Variant 1 stop is 5% under the 11/27 low of 10231.25. That’s long time to have that stop and it’s way away, but that’s the system. It withstood the 8%+ downwave of January and February so it must have some validity.

Another thing you can do is struggle against your fate and buy some puts, sell some calls, buy some VIX futures — volatility is low right now in general — but since we’re not doing any of these things ourselves we haven’t checked any specifics. You could also buy some of the ETF short indices issues.

A downwave is 100% inevitable. But Karnak got off with our crystal ball so we don’t know when. Of course you can always just treat this downwave like the last one that was 8% or so. Yawn. That was more entertaining than watching paint dry, but let’s get back to boring.

We haven’t decided what to do for our personal accounts (see our struggling against the fates in the Euro), but when we do our readers will be the first to know.