http://stockcharts.com/h-sc/ui?s=$INDU&p=D&yr=1&mn=0&dy=0&id=p52855211355&a=205639989

(This letter depends on the reader’s having read Technical Analysis of Stock Trends, 9th Edition Chapters 28 and 28.1, and/or StairStops. Your survival in the market depends on your having read those same books.)

The stop is the essence of risk control. If you don’t have it you are at the mercy of the market and the talking heads (who don’t have it).

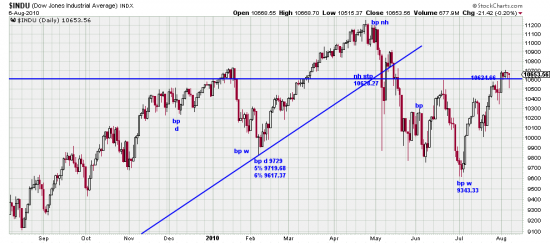

In this chart of the Dow the Basing Points short stop was just tripped, putting the system long. The weekly Basing Points system (Variant 1) never got short. It remained long through this entire disruptive downwave. This appears to us to be double justification for being long the market. With enormous trepidation. You can get your head torn off in a week in these markets. On the other hand, think of it like this — it’s like white water rafting or brahma bull riding for fun and profit.

The chart illustrates stops created at Basing Point d (bp d, for daily) in November. All Basing Points are not created equal, and this one is (was) weaker than a wave low Basing Point because it was created from a sidewave, so the market never got to pass through a natural downwave before its creation. Three stops are illustrated here 9729 (imprecise) and at 5% 9719.68, at 6% 9617.37. At the low of the downwave the 5% stops were taken out. At the time we demurred and doubted the validity of the price action, and attributed it to stop hunting (which it was). Nonetheless we closed most of our longs. Because we had been operating with the daily stop using a 5% filter.

At the same time the weekly Basing Stops system had a stop at 9343.33 which was never endangered. That’s a long way for stop hunters to run. To reach a stop like that you have to have a valid change of trend.

Given that the bp d stop was tripped this put the system into a theoretical short — which we declined to take, making it a paper trade. This activated the Basing Point in June with a stop to go long at 10624.66. This would have stopped out a short trade.

Ironically this stop is within whistling distance of the Basing Point Variant 2 stop of 10628.27 which was created at the wavehigh in April (bp h). As a brief reminder Variant 2 Basing Points are created by new highs rather than wavelows. Had a trader taken this stop he would have avoided all the grief that subsequently occurred.

In general we try to avoid burning out reader neurons with discussions of this detail (it doesn’t do anything for our neurons either). But the point here is larger than just this discussion. The reader/investor must decide whether to trade on a daily or weekly basis, and whether to attempt to ameliorate short and medium volatility by hedging (or wriggling like a worm on a hook) — or as that one armed economist says, damned if you do, damned if you don’t). It just so happens that the particular shape of this market illustrates beautifully the difference between the two different scale systems.

Here is the weekly graph which shows how the weekly Basing Point was generated — in which the sidewave of bp d just disappears as unimportant, which, of course, it was.

…and the market may be in the process of forming the right shoulder of an 8-month head and shoulders pattern with a declining neckline. Time will tell.