http://stockcharts.com/h-sc/ui?s=$INDU&p=D&yr=1&mn=0&dy=0&id=p52855211355&a=205639989

It is obvious that the market has not yet settled down. We think that it is expressing strong, if not paranoic doubts about the ability of the Congress to avoid a double dip recession. And considering the competence (and courage (lack of)) of that venerable institution we can well understand its neurosis. Robert Shiller has joined Paul Krugman and ourselves in stating that there are strong possibilities of a double dip recession unless jobs are created. Meanwhile, Congress worries about the deficit. One wonders why they didn’t worry about it when they were spending a trillion dollars in Iraq. Oh. Forgot. That was off budget.

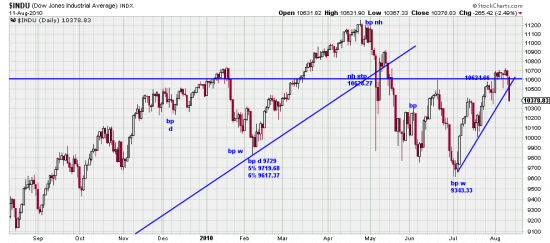

With this economic context we still must look at the market in analytical terms. First, after a wave high you must expect a wavedown. Also, after a breakout you must expect a throwback, as they call it in the trade (or is it a pullback?–anyway…). This wave lasted 23 more or less normal days — the longest and healthiest wave since April. We are inclined to look at today’s exaggerated action as an expression of the pattern we have been noticing for some months in the market — the surge, drift and flush pattern. The market powers up frustrating those who have been timid or hesitant, then as they join the trend price drifts in a tight range for a few days, and then the market flushes out the late comers with a severe down day.

We are doing some research right now on the subject of false signals. The sell signal in July at the bottom of the downwave appears to have been a false signal, and we are not super certain of the buy signal that just occurred. Of course the weekly system, as we have noted, has no uncertainties. It remains unperturbed and long.

We should point out the purpose of the present turbulence. It is meant to discourage and shake out weak holders in the market. When this period passes a trend of large proportions will repay those who have the calmness, patience, and fortitude to follow a systematic methodology. While we have nothing but contempt and disdain for Congress we have unparalleled confidence in the American economy to navigate these rough shoals and resume growth and prosperity. Congress of course can make that more difficult. And has been. From an economic standpoint we are watching with fascination to see if the Congress can rival the unmatched stupidity of the 1930s Congress and the Smoot-Hawley Act. This time they will call it Saving the Nation from the Deficit Act.

Anyway, as we were saying before we got carried away with Congress-rage –with the breaking of the 23 day trend line we can expect some downwave action. How severe is to be determined. And the severity of the downwave will give us some idea of what is to come. Our analysis says that the market storm from April is over– but if price returns to test the lows — which seems unlikely to us at this time– we would change opinion.

In the meantime we would not look askance at anyone who wanted to be hedged in this period. We would expect traders to have sold and shorted today. And — just a hunch — we expect about 5 days of downwave action here.