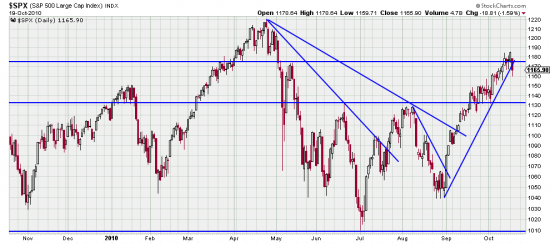

Two crucial events here. The short term trading trendline is broken on a vicious power bar, and price is nose up against the resistance represented by the horizontal line.

And it is also time for something new and entirely different, as Month Python would say.

Very possible that this is the beginning of the downwave. The follow through in the Asian markets sounds like it. Readers should review stop analyses over the past few letters and get set for the downwave.

The Dow wave was 36 days and 12.31%. The gold wave was 55 days 19.25%. When waves are that long the contrarians start salivating, like wolves watching Little Bo Peep’s sheep.

Dear readers if you think today (and whatever happens tomorrow) is the result of Chinese interest rate finagling you have been listening to too many talking heads or believing the news. That way lies bankruptcy and madness. Traders were looking for an excuse to pound the market. They’ve been trying for a few days and they caught it vulnerable and pounded it today. The market is hanging by a thread and they can push it over the cliff tomorrow.

Anyway we calculate that they are unlikely to take back more than 50% of this wave.

If you estimate they are going to draw some blood you can always hedge your portfolio by QID in the Qs, SPXU, in the SPX and DOG or DXD in the Dow.

Looking for a confirmation here.

Alain

Type your comment here…