http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=214966864

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=214966864

Of course this plethora of crocodiles didn’t happen today. It happened 15 days ago, the 22nd, when the chart told traders to get out of the market. Only the great crocodile in the sky had the least foreknowledge of earthquakes, tsunamis, musical chairs and Mohamar Q.

But instead of crying crocodile tears and selling in panic readers can look at this purple swan (too big to be black) as an opportunity. For example you can sell some out of the money naked puts. If they got exercised you would have what you wanted anyway — cheap stocks. If they didn’t get exercised you would have free money. You would also sell out of the money calls. Expensive now, and unlikely to be exercised anytime soon. WARNING. These tactics are for advanced practitioners, or for those who have professional assistance. We rarely discuss options strategies in order not to lead readers astray, but these are tantalizingly obvious.

The general investor should look at this aberration as a buying opportunity as soon as the bump-dump-bump-surge pattern is accomplished.

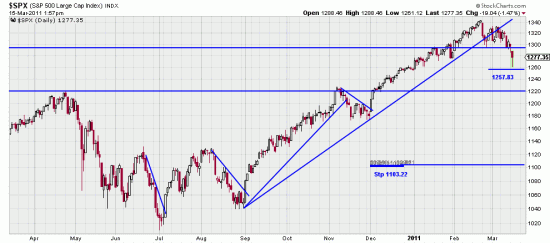

Here, and in recent charts we have noted the stops for the SPX and the Dow. The Variant 2 stop (1257.83,sco) is a stone’s throw away, but if you have decided to use it, don’t hesitate. The system is smarter than we are. The wave low stops (1103.32 sco) illustrated here are a chunk of capital away but we are betting on them. This purple swan that just flew into the windshield at 110 mph is just what’s needed to set up the next leg of the bull market.