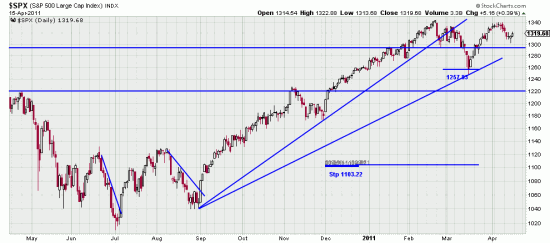

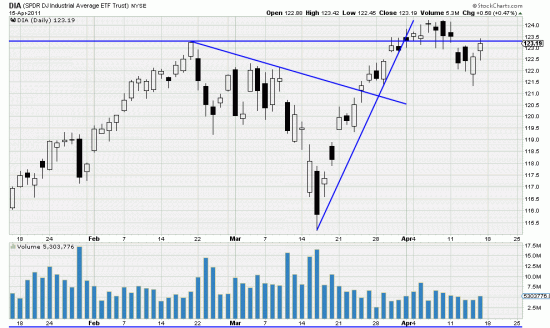

Strangely the dump bump dump pattern, after breaking the downtrend line stalled. obviously the market is well within our stop parameters but strange behavior should always provoke an analysis. Recently many uninformed analysts have been seeing a Kilroy (reverse H&S) pattern here. They are too early, but there might be something in it. Nonetheless the previous Variant 2 stop which was touched on the dump but not exercised is till valid. We are not rigid traders. When stops are hit we evaluate the market and see whether we consider the exercise warranted. We will be especially vigilant if this stop is threatened. But we consider the present behavior well within the definition of a downwave in a bull market.

Strangely the dump bump dump pattern, after breaking the downtrend line stalled. obviously the market is well within our stop parameters but strange behavior should always provoke an analysis. Recently many uninformed analysts have been seeing a Kilroy (reverse H&S) pattern here. They are too early, but there might be something in it. Nonetheless the previous Variant 2 stop which was touched on the dump but not exercised is till valid. We are not rigid traders. When stops are hit we evaluate the market and see whether we consider the exercise warranted. We will be especially vigilant if this stop is threatened. But we consider the present behavior well within the definition of a downwave in a bull market.

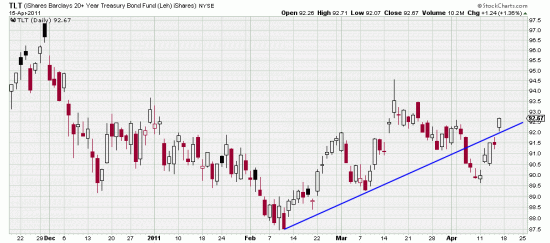

On the other hand in TLT we are ending our short because of what you see here. The black power bar took us short, and the gap across the trendline for us cancels that signal. So we will sell TBT Monday. Clearly some strange goings on. The News traders will be out in force for awhile seizing on earnings reports to create volatility. We expect earnings reports to be generally good and so will enjoy watching the snakes bite each other to death. We expect this running to and fro to be meaningless but if it creates a trend we will take it seriously.

On the other hand in TLT we are ending our short because of what you see here. The black power bar took us short, and the gap across the trendline for us cancels that signal. So we will sell TBT Monday. Clearly some strange goings on. The News traders will be out in force for awhile seizing on earnings reports to create volatility. We expect earnings reports to be generally good and so will enjoy watching the snakes bite each other to death. We expect this running to and fro to be meaningless but if it creates a trend we will take it seriously.

Here is the stall in prices after completion of the pattern, and the making of a new high.