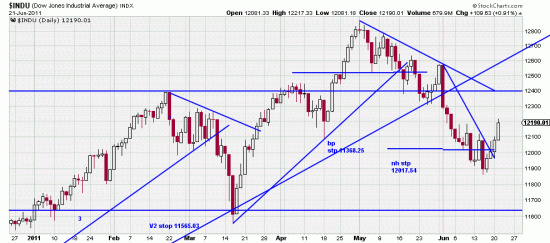

The last three or for days ought to put to rest what the nature of this downwave is (was). It was a test of the bulls arranged by the contrarians. As of now the contrarians are firmly in control and we should see them drive the market to the top of the range and then play musical chairs again. Not a certainty, but a certainty that we are in a sideways trading market. Long term investors are protected by the Variant 1 wave low stop.

The last three or for days ought to put to rest what the nature of this downwave is (was). It was a test of the bulls arranged by the contrarians. As of now the contrarians are firmly in control and we should see them drive the market to the top of the range and then play musical chairs again. Not a certainty, but a certainty that we are in a sideways trading market. Long term investors are protected by the Variant 1 wave low stop.

A technical note: the latest short downtrend line which the power bars have jumped across is really a technically weak line because there has been no “bump” during this time. Conservative and prudent investors can avoid the uncertainty here by waiting for either the piercing of the downtrend line from the top, or even waiting for a new high.

Readers should be hyper aware that the game has changed again. For the foreseeable future long term investors will be hedged, out or will be trading.

Indicative of the change of markets RIMM roared up, ending short trades.

Now a word about the purpose of all this. We have often pointed out that before you can have a real good bull run you need to flush out the public and those who bought near the end of the previous run. This may have been the flush, and, at any rate we should treat it as such.

Notice that nothing has changed in the economic situation, in the Greek situation, in the foreclosure situation. Oh. There was one change. Newt the beaut lost his money raisers who left to join his campaign staff.

We will be buying the indices tomorrow for our money account.