Readers may remember the horror story of some years back of a bridge that a barge ran into, knocking out a section. It might have been over the Missouri. Motorists racing across the bridge plummeted to their death.

Readers may remember the horror story of some years back of a bridge that a barge ran into, knocking out a section. It might have been over the Missouri. Motorists racing across the bridge plummeted to their death.

We have the queasy feeling that we are driving across that bridge right now. And it is the fools in Washington who are going to knock a section out of the bridge. Frankly we are having a hard time imagining what the market is going to do if these “political leaders” don’t get the debt limit renewed. Would the market plummet to its death? Or is the market saying right now –“No problemo.” Or has it not occurred to the market that this game of chicken might result in death?

In the old days chicken did sometime result in death — when two crazed teenagers drove cars into each other — or lay down in a street in the dark and were killed by a car.

The market it is a crazed buying binge. The major indices — without exception. We bought them the third day into the explosion and they are still buyable — in fact the Qs just made new highs. IJK, IWM,MVV — just throw a dart at a board.

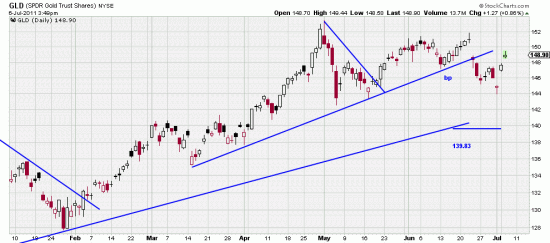

Well whatr if they do knock a section out of the bridge — market down 1000. We are strongly considering a little hedging: GLD is buyable, although becalmed at the moment. If the bridge collapses it may be too late to buy it. Also, VXX — if the market goes off the bridge VXX should go through the roof. We haven’t bought these yet, but are shifting back and forth from one foot to the other and watching cars whizz along the bridge and wondering whether the pols are so stuck in their positions that they are steering the ship of state toward the bridge supports.

Compute the probabilities yourself — but don’t just whizz along without making certain there is till bridge where it is supposed to be.