We were of two minds about Friday’s action. Our rational mind said, a natural reaction to a surging upwave. Our irrational and paranoid mind (which got reinforced Sunday) was it looked funny. Today, Sunday, the Times reports that Boehner has thrown in the towel on a deal with the White House on the debt ceiling– says he can’t pass a deal with “tax increases” (thought we were going to call them “revenue enhancers”). Whatever we call them it’s not going to happen, which means we are one day and one giant step closer to default. The market which has been blithely speeding across the bridge to nowhere should at this point throw up convulsively at the prospect (increasingly likely) that economic troglodytes will allow the most powerful and richest country on earth to act like Greece (Ireland? Iceland? Portugal? or worst of all, like Italy (viva Berlusconi — what a macho!))

We were of two minds about Friday’s action. Our rational mind said, a natural reaction to a surging upwave. Our irrational and paranoid mind (which got reinforced Sunday) was it looked funny. Today, Sunday, the Times reports that Boehner has thrown in the towel on a deal with the White House on the debt ceiling– says he can’t pass a deal with “tax increases” (thought we were going to call them “revenue enhancers”). Whatever we call them it’s not going to happen, which means we are one day and one giant step closer to default. The market which has been blithely speeding across the bridge to nowhere should at this point throw up convulsively at the prospect (increasingly likely) that economic troglodytes will allow the most powerful and richest country on earth to act like Greece (Ireland? Iceland? Portugal? or worst of all, like Italy (viva Berlusconi — what a macho!))

We suspect that the explanation for Friday’s action — hard sell off, partial recovery — is insider information coming from Congressmen who knew Boehner was going to leave Obama out on the limb, while his compatriots were gaily sawing on the branch. The Times also notes today that the portfolio performance of Congressmen and Senators (privy to insider information, and making laws and tax policy on the stocks they hold) is radically better than average, and radically better than yours. Of course it is. That’s the purpose of insider information.

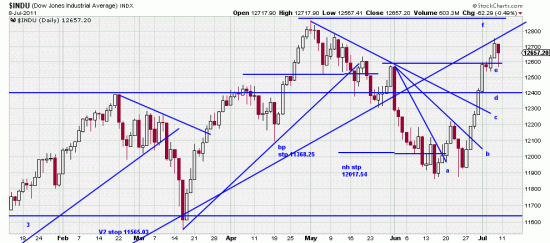

We have over the last several weeks harped (like Irish Troubadours) on hedging and protection. In fact after our last letter in which we contemplated buying gold and VXX as a hedge we did it before the close on Friday. But it is hardly a perfect hedge as we have been heavily long the inidices since the third day of the rally. If the market has a brain in its head it will open sharply lower on this news and the trap will be shut. Except on Members of Congress, who will be rewarded for their ideological purity by being reelected by their brain dead constituents. If the market gives us half a chance we’ll bolt like rabbits. That’s a trading decision. If you are protecting your positions with Variant 1 wave low stops experience says the best thing to do is treat these minor panics as amusing and transient phenomena.

Meanwhile Nero fiddled on, and enjoyed the bonfire, like a kid watching fireworks. (Remember — one reason Nero burned Rome was as an early form of urban renewal.)