First. The market blew away the two nearest highs, destroying the declining pattern. Someone referred to the Oct 4 low as a bear trap, as well it appears in retrospect. Didn’t trap us because we didn’t trust it anyway. In fact we don’t trust anything about these markets. Subsequent price behavior illustrated once again that a failed signal indicates the next signal in the opposite direction will be a profitable one (in general). In general that was true in spades as the S&P surged 13.9%, pinching the toes of bears. (Us, in general, though we caught a part of the wave on a trade.)

First. The market blew away the two nearest highs, destroying the declining pattern. Someone referred to the Oct 4 low as a bear trap, as well it appears in retrospect. Didn’t trap us because we didn’t trust it anyway. In fact we don’t trust anything about these markets. Subsequent price behavior illustrated once again that a failed signal indicates the next signal in the opposite direction will be a profitable one (in general). In general that was true in spades as the S&P surged 13.9%, pinching the toes of bears. (Us, in general, though we caught a part of the wave on a trade.)

Second. Readers are undoubtedly aware of the historic markets that are battering them. Normal — average — Dow volatility, close to close is .87%. During this period we have had starting with September 21 moves of greater than 1% on 11 of 13 trading days. Five moves were greater than 2%. The average move since August has been 1.69%, or almost twice historical normal. This is like a perfect storm at sea. Watching this typhoon we silently pray that our readers have done as we counseled — hedged or sold and watched with equanimity. These are not only no markets for the general investor, they are no markets for professionals and the WSJ is full of stories of hedge fund managers folding and mutual funds eviscerated. Barron’s touts on its cover three mutual funds of exceptional excellence… whose funds are in rags and tatters and thus are cheap to buy now. Just as Enron was cheap at the end of its life.

The October 9 NY Times Mutual Fund Report pictured a batttlefield littered with casualities. The leading mutual fund was up 2.4%. The lagging funds were down 32.7 to 42.3%. Did we mention that we despise mutual funds? (They disrespect us, also. That’s not the reason we dislike them. We disparge them because they are primarily vehicles for the collection of fees and income for the managers and owners, not vehicles for the profit of the investors. Also they are in total ignorance as to the analysis of trends. Professionals? Professional fee collectors.)

Third, well what do you do when you are in a typhoon? Take a reef in the mainsail.

Never never move your stop away from the market, says every competent trader who ever traded. Watch closely. We are about to move our stop away from the market.

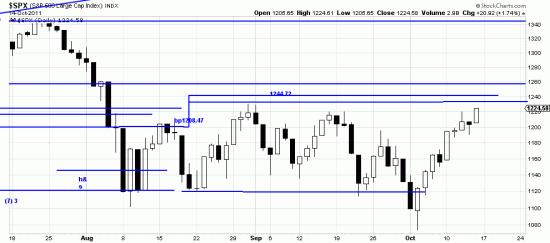

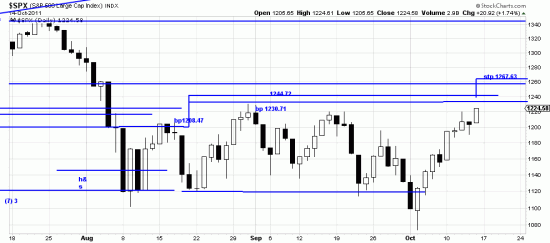

The stop on our short, or, the stop to put us long the market is illustrated on our SPX chart at 1244.72 calculated from the Basing Point at 1208.47. Given the volatility of the markets this stop is too close. We are raising it to 1267.63. using 1230.71 as the Basing Point on 8/31. We urge readers to use their own judgment in evaluating this analysis. We should say that the Basing Point procedure calls for the adjustment of filters based on volatility conditions, so Magee would not have a stroke at this maneuver. Also, by moving the stop up we test a penetration of the highs of this devilish formation for validity. The SPX model applies to the INDU also.

Here is our interpretation of what happened this week: a rocket like advance fueled by lack of selling with numerous participants drawing back out of caution or fear, and bears not believing it. The fall of the two wave highs convinces us that we will be in the formation for awhile yet. But– it is always possible that just as there was a bear trap that there will be a bull trap. The posture to the markets remains to trade, to stand aside or to hedge. We expect the next wave to be down.

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=3&dy=0&id=p32138754284&a=214966864

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=3&dy=0&id=p32138754284&a=214966864