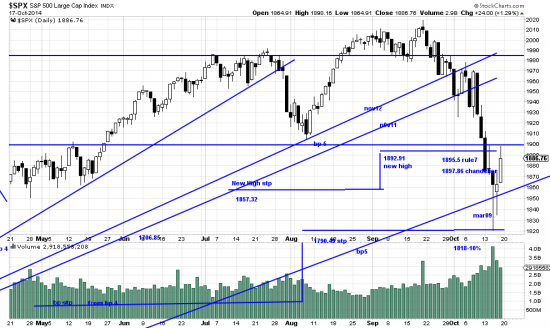

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p45656388815&a=266398464

After quite some contemplation and analysis we concluded that the down wave is over — for the moment at least. How long “over” lasts is now the question. Could be a wave, could be a ripplet (a day or two). At any rate, as someone remarked, the “taper tantrum” appears to have exhausted itself.

Readers should be alert to the fact that any analysis from anybody (ourselves included) under present conditions is roughly as dependable as crystal ball analysis. We can offer an analysis and we can demonstrate our confidence in it by putting our capital on the line. But more animal cunning and deep experience is involved here than analytical skills.

As for analysis: It may be possible that the mar09 trendline (labeled), as well as the wave low stop (1709) have functioned as suppport and arrested the down wave. Readers will remember that we have repeatedly advocated for the use of wave low Basing Point stops. Seeing what appears a reversal we lifted our hedge and added on to our UPRO poosition. We also closed some shorts because of the transient patterns. We closed our short euro position our short energy position (XLE), and our short $Rut position. We still think these markets have downside potential but we don’t want to fight the short term wave. We are still short Silver.

C wave hit 1.618 A and reversed..

I am as fascinated by the golden section as everybody else, but I am also much aware of the search for the philosopher’s stone. Magical numbers in the market are nothing more than accidents — or like attempts to find a cypher in Shakespeare. That way lies madness. AS I go down the road I note the skeletons in the ditch who died tryng to make fibonacci numbers (or the golden ratio) yield up the secret of the market. The secret is, there isn’t any.

cb