http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p22775897357&a=266398464

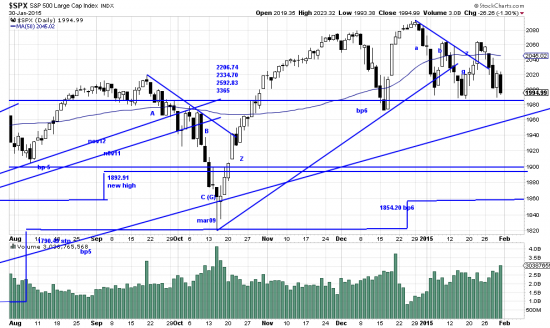

The market reacted very badly to Mitt’s withdrawal. But ours not to reason why, but to reason how and what. The what is that the zeta wave has failed and this has ominous implications. Which are — sideways to down. Economic events have driven the market to this extreme. Among them (not all by any means but important some): primarily the repricing of oil in the world economy; Greek turmoil; EU ineptitude; German intransigence; Russian adventureism; — and not least an aging bull market in catatonic anxiety fearing Fed actions.

Naturally all of this gets priced into the market which is telling us to beware. Be very wary. So far all the market has done is take back some of the profits we have garnered since March 09. A protracted downwave could be more that 10% painful. We are working on a more comprehensive analysis of the situation which we will publish very shortly. In the meantime suffice it to say that we have pared back sharply in our SPX (UPRO) positions and ramped up our hedge trade (SPXU). As we noted with excelllent timing we closed our gold trade just in time to miss the little upsurge (We don’t like having a top gap closed) and our short euro and short oil trades are still on. We noted on zerohedge that Optiver, a Dutch trading firm is in court over blatant efforts to manipulate oil prices by smashing the futures market on the close, as someone did Friday.