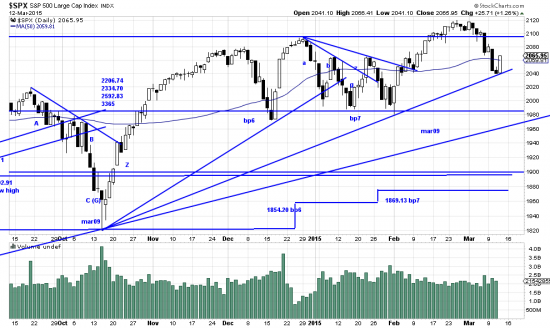

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p09524411098&a=266398464

ABGZ waves: http://www.edwards-magee.com/?p=3776 Background for new readers.

Friday and Tuesday felt so violent that we thought it might be climactic. Climatic without any preceding acts. If this is so then as we noted those days are the alpha wave and today is the start of the beta wave. If this is a garden variety beta wave we should see some more upthrust in the near future, then a downwave that tests the A wave bottom. But remember that in Oct14 the recovery from the sell off was a V wave. So as in all things of this most perfect of perfectable worlds we never know till later. But if you look to your risk management that is usually good enough. Remember if we had perfect certainty this would not be any fun, and we would have to take up video games. (Or politics.) (No that would be like cleaning cess-pools.) We lifted most of our hedge and also adjusted our GVAL trade as in adjusted it out of the portfolio. If we had unlimited capital we would have doubled up and if we see a buying opportuity we will go back in.

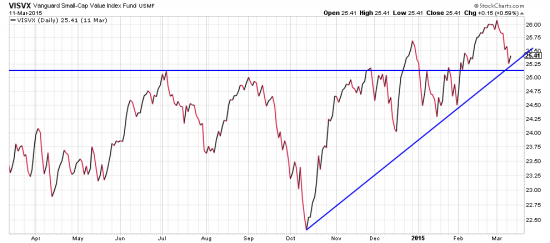

We have another situation like that in small cap value stocks:

Ordinarily we only use ETFs, but the Vanguard small cap index fund is probably one of the few ways to invest in small cap value conveniently. We wouldn’t be buying it in size right now, and we would have a really long time scale. But the research inidicates that this category outperforms almost all others. But we look at it as a very long term investment which ought to be managed with the weekly Basing Point system with wide filters. The Feb low is the Basing Point and the stop would be 6% down if you were in the issue now. If you weren’t in you would want to wait for a bottom to the present downwave.

Interesting, but a golden opportunity? Not like the short in gold.

http://stockcharts.com/h-sc/ui?s=GLD&p=W&yr=4&mn=0&dy=0&id=p08189587686&a=355293399

The recent upthrust was a bull trap as we suspected at the time though like Charlie Brown we took the trade. Now we are building a short position in GLL. It goes nicely with our short Euro position.