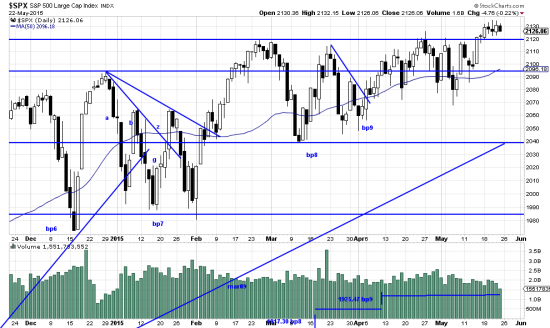

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=6&dy=0&id=p09524411098&a=266398464

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=4&dy=0&id=p34003818356&a=407475521

The famous (relatively) trader Ed Seykota is supposed to have said, “I can’t believe how long it took me to believe what I was seeing.” (Market Wizards — Schwager)

A huge part of the investment community can’t believe in a bull trend of the present length. And here is a secret about trader psychology: if they have missed the trend they want to catch the top and cash in on the countervailing trend. Guaranteed. So, the source of the growsing and constant predictions of catastrophe.

We have stared at the charts until our eyeballs were bleeding and all we can see is a huge trend in the present state of moderate degeneration. But we can’t see any sell signals. As above the price has broken out of the wedge. (We are not really convinced.) The deterioration is represented by quiescent volatility and a divergence in the Dow Theory indices. Industrials up, Transportations down. Last letter we spoke of hedging — and we still think that might be a good idea. Things are entirely too quiet our gut says.

We will this week review stops and other protective measures.