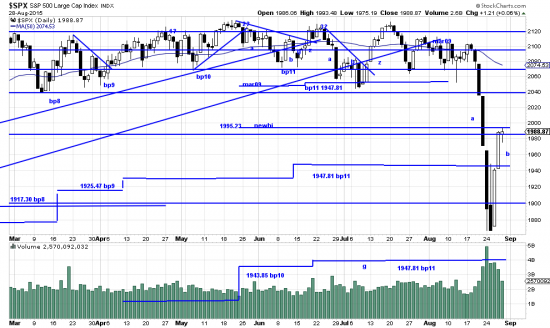

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=6&dy=0&id=p76542086636&a=266398464

When all about you are losing their heads…

Contrarians are never at a loss for a trading plan. They buy oversold and sell overbought. So when unprepared investors are flopping about like chickens with their heads cut off contrarians are happy to take advantage of them.

Edwards & Magee investors are the possessors of an organic trading plan: invest in the major trend, ratchet stops as the trend progresses and hedge or exit when the trend changes. This is a very profitable method in major trends like that which has existed since March 09.

The great stress to any method occurs in periods of transition, or uncertainty. These periods are often marked — especially in modern times — by extreme volatility. In general Magee systems are dynamic and flexible. They take volatility into account and expand stop filters to avoid being picked off by hostile traders. But they operate in a context of historical price behavior. 1000 point Dow moves are outside their experience.

Thus the systems are confronted by a dilemma when volatility is so great that it trips stops intended to identify a major trend change. Or perhaps better to say that the investor is confronted by a dilemma. Take the systems stop and exit and then see that the price behavior is a fake signal. Market rockets on and investor grinds teeth and agonizes over reentry. We believe that these market plunges are not all natural. Hostile traders and antisocial contrarians deliberately create volatility for their own profit and the discomfort of the “muppets”.

We are systems traders. And we are also situation traders. Meaning that our wide experience with systems allows us to discriminate and recognize when the system and the chart are at odds. So we believe that situations occur which the system can’t deal with. In these situations tactics are emphasized — such as buying oversold and selling overbought, among others. Sometimes these situations are dealt with by judgemental trading. We have compared this to naked mud wrestling — or knife fighting with 3 inch Swiss army knives.

We observed the systems stop for accounts run on this method, but almost immediately decided that the sell-off was a test, not a change of trend and lifted the hedge and bought more UPRO.

Which brings us to the present. Contrarians spooked the herd last week and drove the Dow down by 1000 points at one juncture. This action tripped all the systems stops. We now must evaluate the market and determine if we think we have a true change of trend or random terrorist behavior. Judging by volume behavior the present downwave is not a change of major trend, but an effort by the “Composite Operator” to dislodge long term holders. Traders who missed the bull market are driven crazy by the prospect of long term investors wallowing in profits.

We may use the A-B-C (A-B-G-Z) wave model (http://www.edwards-magee.com/ggu/alphabetazetawaves.pdf) to look at the present structure. This analysis would put us in a B wave (the A wave ending the 24th). We will get more information on this next week. B waves can be very profitable as they gain energy from the oversold conditions which precede them.

There is of course a secret method to determine whether the bottom is in. This is done by using the Magee three-days-away procedure. Take the 24th bar and when we have three closes outside its range (up) we mark the end of a wave. It is always possible that a C or gamma wave will test that low, meaning that agility will be tested, or if the low is taken out we might have more than a stop test — a downtrend.