http://stockcharts.com/h-sc/ui?s=AAPL&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=456428947

That ugly gap on the chart is one of the reasons we don’t like to trade stocks. Somebody doesn’t answer the phone and the stock wakes up down 5 or 6%. But it is what it is and market insults result in a buying opportunity. Apple has led nothing but a turbulent life with the pundits and Wall Streeet “owls” predicting imminent demise or, reluctantly, fabulous fortune. The company attracts disdain and disrespect. Before Apple blew everybody away with the iphone the internet tech community trolled the Apple user community in favor of Microsoft and IBM.

Now the stock is in a downtrend with lower highs and lower lows. Ordinarily this would prevent an investment. And in fact, if interested you might want to wait until the downtrend line is broken. It will be broken and Apple will pull another rabbit out of the hat. If you are impatient the stop is 4% down.

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=6&dy=0&id=p70142979615&a=266398464

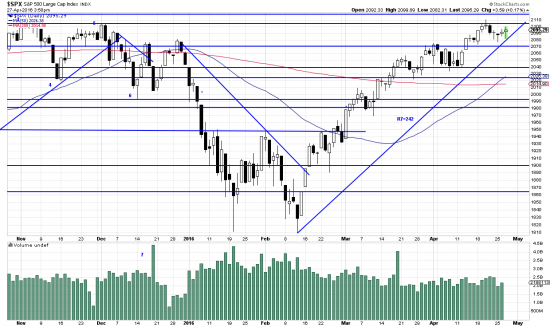

Meanwhile the strength and persistence of the present wave continue to persuade us that we are looking at the beginning of a new major upwave. Here is a way to look at participating in this new market. If you make a trade you scale in — dividing the alloted capital into 3 to 5 tranches and stopping up the first trade 4-5% down. The other tranches are laid on as the price advances and according to the chart pattern.

We regard this as a new market. We consider that the mar09 bull market ended with the breaking of the mar09 trendline in 2015 accompanied by 14 months of sideways to down price action. This process has been exacerbated by rapacious activity on the part of HFT traders and their ilk. Nevertheless we foresee improving economic activity and continued healing. And of course it’s still the only game in town.