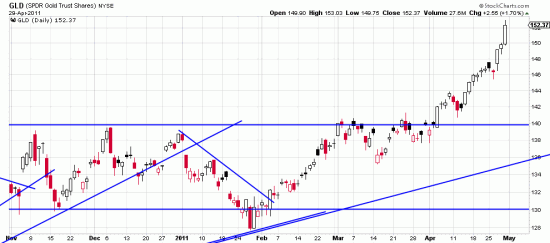

We are not jealous of our readers. And thus, when we see comment that we think might be of value we call attention to it. So a short time ago we mailed a link at Minyanville to the google groups, edwards-magee, and johnmageeta. Readers can catch it there. We will comment on the comment below. First, the gold chart:

We are not jealous of our readers. And thus, when we see comment that we think might be of value we call attention to it. So a short time ago we mailed a link at Minyanville to the google groups, edwards-magee, and johnmageeta. Readers can catch it there. We will comment on the comment below. First, the gold chart:

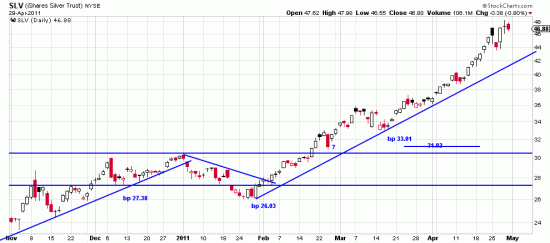

Gold is taking over from silver as the hot market. For the aggressive speculator these are pyramid signals. For rational investors time to buckle seat belts. Silver went semi-parabolic and now it looks like gold is doing the same thing. Readers can go back to our letters on silver for suggestions as to stops and management of markets in acceleration. Tight stops under day lows, using low of high days as a Basing Point, etc. Distressing as it might be from a profits viewpoint the true wave low Basing Point is the low in Feb. You could make one out of the low in March. Filter 5 or 6%.

Gold is taking over from silver as the hot market. For the aggressive speculator these are pyramid signals. For rational investors time to buckle seat belts. Silver went semi-parabolic and now it looks like gold is doing the same thing. Readers can go back to our letters on silver for suggestions as to stops and management of markets in acceleration. Tight stops under day lows, using low of high days as a Basing Point, etc. Distressing as it might be from a profits viewpoint the true wave low Basing Point is the low in Feb. You could make one out of the low in March. Filter 5 or 6%.

The letter at Minyanville does some good work in pointing out that in the past when silver has fallen off a cliff it has picked a high cliff to fall off of. 62% or to the 200 day moving average. Our problem with these observations is that that was then and this is now. You still have to make a decision as to where to put the stop or whether to pull the trigger or cut and run.

For example last week we blew out some really long term positions because we did the same study the Minyanville guys did. But it may have been a head fake — note may — no one knows yet. It is undecided as to whether what looked like a top to us is — or isn’t. If we had a big position in silver we’d be watching this market in real time — and if we saw a black power bar developing during the day, we’d blow it out on the close.

Remember there are other position management alternatives: i.e., if you think the chances are strong that the market has topped you can scale out of some of your position. S0 you don’t have to be all right or all wrong. Scale out in tranches. 1/3 out — market down, out another third, and so on.

For even rational investors we think using new-high lows as a Basing Point with a filter may be warranted. Just be aware that if you have capital you like in this market you’re sitting on a powder keg. Readers who don’t have a stop in this market will be punished by the teacher. Also by the market.