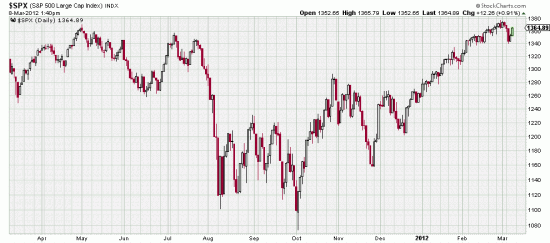

Look familiar? Well, to get here we had to endure a serious head and shoulders top and its consequences — about the roughest patch of Cat 5 water seen for some time. The top warning saved a chunk of paper equity and the system (Basing Points) got us long again in late October.

Look familiar? Well, to get here we had to endure a serious head and shoulders top and its consequences — about the roughest patch of Cat 5 water seen for some time. The top warning saved a chunk of paper equity and the system (Basing Points) got us long again in late October.

Just in time for the 55 day run that was so profitable. Then Tuesday the market threw the fast ball. Or it may have been a knuckle ball. As everyone knows if a knuckle ball doesn’t hit you it’s hard as hell to hit. We suppose (without much real knowledge) that it is like a googly in cricket. Regardless, its effect is to sow confusion in the batter’s mind. So Tuesday looked like a knuckle ball to us and we took a lot of profits (good profits) and took the day as the beginning of the avalanche.

Just in time for the 55 day run that was so profitable. Then Tuesday the market threw the fast ball. Or it may have been a knuckle ball. As everyone knows if a knuckle ball doesn’t hit you it’s hard as hell to hit. We suppose (without much real knowledge) that it is like a googly in cricket. Regardless, its effect is to sow confusion in the batter’s mind. So Tuesday looked like a knuckle ball to us and we took a lot of profits (good profits) and took the day as the beginning of the avalanche.

Maybe not, and considering the lack of downside follow-through it might have just been a high brushback. Same as with knuckle ball, if brushback doesn’t hit you it scares you to death. Prospect of 90 mph ball coming at your face dissolves courage with incredible rapidity.

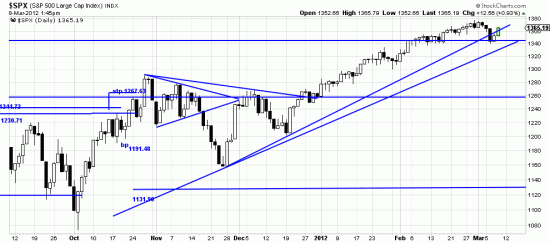

We said, and wisely, that readers who ignored the Tuesday event and observed the system stop would be best off. Now we (who played short term trader) are in that old trader’s quandry: reentering. We got back into the Qs and still have our UPRO position, though scaled down. And we booted the TVIX with a small loss. We will explain our reentry process as we reenter.

Now, why would a 200 point day in the Dow have so little follow-through?

Our estimate is — that we are sitting on the cusp of a historic bull market. Our personal accounts will take this as a given over the next year. Over the weekend we will address the question in a major letter –fast balls on steroids.

Remember, as Yogi said, good batting beats good pitching. And vice versa.