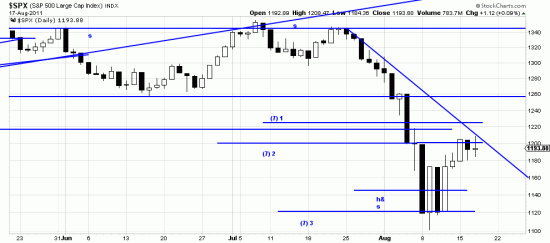

We are not hostile to “swing” trading. Which is, in essence the contrarian or trader’s effort to catch trends of limited duration. August 8 contrarians saw a situation they dream of –panic market, oversold, market ripe for the “dead cat” or automatic bounce. So some bought the falling knife and some waited to the next morning when they piled in long and drove the market up 53 points, basis SPX. Agile contrarians sold their positions on the close. Less agile watched the market take back the 52 points the next day, presenting them once more with the situation of the 8th — panic selling, oversold market — so they piled in the next day and drove the market back up.

We are not hostile to “swing” trading. Which is, in essence the contrarian or trader’s effort to catch trends of limited duration. August 8 contrarians saw a situation they dream of –panic market, oversold, market ripe for the “dead cat” or automatic bounce. So some bought the falling knife and some waited to the next morning when they piled in long and drove the market up 53 points, basis SPX. Agile contrarians sold their positions on the close. Less agile watched the market take back the 52 points the next day, presenting them once more with the situation of the 8th — panic selling, oversold market — so they piled in the next day and drove the market back up.

Now naive money saw the surge and joined in, thinking this was March 6 of ’09. It’s not.

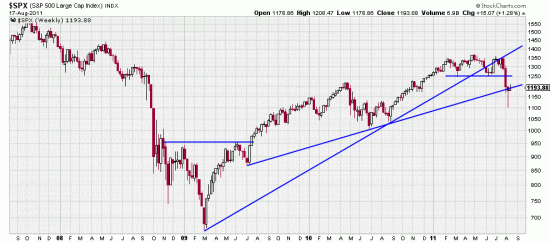

March of 09 was not the V bottom it appeared to the short of vision. It was actually months in preparation.

Note the numerous instances of panic selling and the numerous instances of contrarians jumping on for the automatic bounce. Note also the distinct resemblance (in retrospect) of the Kilroy or upside down bottom — here presented with a very long nose, or head, making the superficial analyst think a V bottom had occurred. Note also the long term trendline the market is bouncing off right now.

Note the numerous instances of panic selling and the numerous instances of contrarians jumping on for the automatic bounce. Note also the distinct resemblance (in retrospect) of the Kilroy or upside down bottom — here presented with a very long nose, or head, making the superficial analyst think a V bottom had occurred. Note also the long term trendline the market is bouncing off right now.

In our analysis this trendline is not strong enough to stop the downwave. As seen from the first chart the market is in the process of setting up the A-B-C pattern, or as we have called the short term variant, the alph-beta-gamma-zeta pattern. We analyze that the market has likely completed this “swing” as seven days fits with prevailing wave rhythms. If this is accurate we will see a C or gamma wave here caclulated to punish the naive who joined in the contrarian wave. The contrarians will be short, driving the C wave.

When this C wave has exhausted itself the true Zeta wave will develop and take out the tightly sloped trendline just drawn on the chart. Even if this occurs, prognostics for the market are dark. A number of important targets as pointed out here have been achieved. These targets were minimums. Or probable minimums. Almost always the market goes ahead to inflict serious pain — as we saw in ’08-’09.

This means short positions and bear market tactics and strategies are still in order. We are amazed, astounded, amused, aghast to see the punditry and talkingheadery busily sorting through the wreckage for bargains and stocks to buy.

And, if this doesn’t work? It will be the first time this year (Month?) (Week?) (Day?) we have made a mistake. Well, maybe the second.