http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p97142210271&a=214966864

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p97142210271&a=214966864

It is our policy that when there is nothing to say we don’t say it. There has been nothing to say about the market all week. Lots to say about them Giants and about Sandy. Meanwhile after two days of market closure and prices marking time, Friday spanked the market.

Here are the conditions: The trendline from June is broken. We have a pattern of lower highs and lower lows. All the nearby lows are broken. There is a very toppy looking pattern from mid September. This doesn’t sound very positive, does it? But, strangely, we are quite bullish. Why on earth? (or Mars?) Well, in three days the pall of uncertainty hanging over the market will lift and suddenly we will see the next four years clearly. We expect Congress to do some positive things by year end. After all they will no longer be obsessed with making Obama a one term president. Then there is the old seasonality saw — sell in May and go away, buy at Halloween and make hay. And then — we think the economy is ready to bust out.

So we will be watching closely to lift our hedges and bet the ranch. But we’ll do it in tranches. We’ll start with the outhouse.

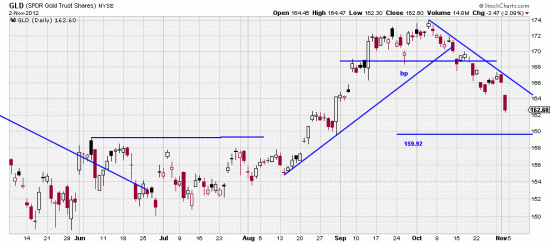

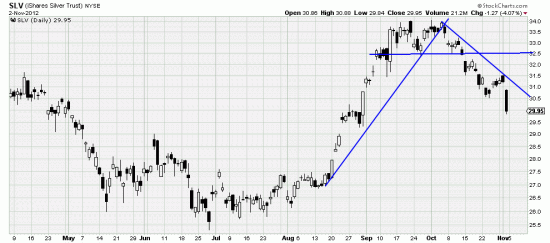

The analysis of gold and silver we made some time back has been productive.

http://stockcharts.com/h-sc/ui?s=GLD&p=D&yr=0&mn=6&dy=0&id=p25530259881&a=234983962

http://stockcharts.com/h-sc/ui?s=GLD&p=D&yr=0&mn=6&dy=0&id=p25530259881&a=234983962

Friday showed a gap down in both metals and we will be increasing our bet in the gold and laying on a position in silver (short).

As can be seen the two markets appear to be closely correlated.

As can be seen the two markets appear to be closely correlated.